Messari’s Unqualified Opinions Issue #5

TLDR:

Bitmain dropped a 432-page disclosure report yesterday in preparation for its IPO on the Hong Kong Stock Exchange. KWu’s got you covered. Pushing my (TBI) part two post from Tues - how to simply regulate crypto liquidity providers - to Monday instead.

Is Bitmain unstoppable?

After months of speculation, Bitmain is officially on the path to doing an IPO (yes, your traditional stock market kind, not an ICO) on the Hong Kong Stock Exchange.

Yesterday, the company filed its 432-page application to be reviewed for listing. (Chinese version here, English version here) Of course, I sat down immediately and started pouring through the details.

Some interesting stats for you to know:

ON BITMAIN’S FINANCIALS

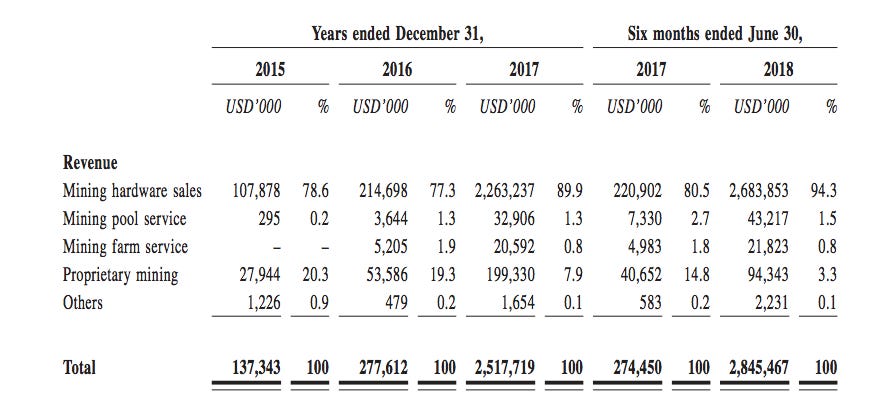

In the first half of 2018, Bitmain’s revenue was $2.845 billion, with a net profit of $1.123 billion. 95% (!!) of revenue comes from the sale of $2.56 billion in mining hardware. Surprisingly, only 3.3% of Bitmain’s year-to-date revenue comes from “proprietary mining”.

(Editors note: an earlier edition of this newsletter misstated the $2.56 billion figure)

It take money to make money: the company’s cost of sales in this time period was up over $1.8 billion - 64% of revenue.

[TBI Note: The company reported Q1 and Q2 of 2018 on a consolidated basis, so a major missing data point is to understand how cost of sales changed QoQ. Difficulty has been skyrocketing, while prices have more than halved, and Bitmain rigs are market priced on a near real-time basis. It’s unclear how far gross margin has fallen, but if I were a betting man (and I am), I’d think Q1 GM% would be closer to 50%, and Q2 closer to 20%. The viciousness of the mining market.]

Surprised by the 3.3% revenue figure from “proprietary mining” (aka self-mining)? Bitmain offers this in the disclosures document:

“In additional to offering products and services to our customers, we also engage in proprietary mining. To capture the profitable returns of cryptocurrency mining, we will utilize mining hardware to mine cryptocurrencies ourselves”. In terms of revenue generated by mining, self-mining has been steadily declining from 20.3% of total revenue in 2015, 19.3% in 2016, 7.9% in 2017, and 3.3% in (the first six months) of 2018.

Together, the two mining pools contributed ~37.1% of the aggregate hash rate of the bitcoin network. While BTC.com mainly targets Bitcoin and Bitcoin Cash, Antpool mines ten types of cryptocurrency, including Bitcoin, Bitcoin cash, Ether, Litecoin, and Dash. Bitmain generally collects up to 5% of the total mining rewards generated from its operation of the mining pools.

GLOBAL FOOTPRINT

Bitmain also has three mining farms currently under construction in the U.S.: Washington State, Texas, and Tennessee. The expected operational date is 2019 Q1, and a maintenance/repair center will also be set up in Washington. Bitmain is considering setting up mining farms in Canada’s Quebec province, as well.

Bitmain runs operations (offices, warehouses, operational uses) around the world, including Hong Kong, the U.S., Brazil, Georgia, Israel, Kyrgyzstan, Malaysia, the Netherlands, Russia, Singapore, and Switzerland.

ON THE IPO

Bitmain plans to list on the Hong Kong Stock Exchange via a weighted voting right structure. For those unfamiliar, “weighted voting” was only recently approved by the HKSE earlier this year. This is only allowed for what the exchange deems to be ‘innovative’ tech companies with a $10 billion+ HKD market cap and $1 billion+ HKD revenue in its most recent financial year (divide by eight for the USD equivalent). The structure essentially introduces dual listings in Hong Kong by technology companies who are already listed in the US as ADRs.

Bitmain’s two largest shareholders are, unsurprisingly, its two founders, Micree Zhan and Jihan Wu. But most people don’t realize that Jihan is actually the #2 at the company in terms of ownership. Today, Micree Zhan owns 36% of Bitmain, while Jihan Wu owns 20.25%.

ON BITMAIN’S TEAM

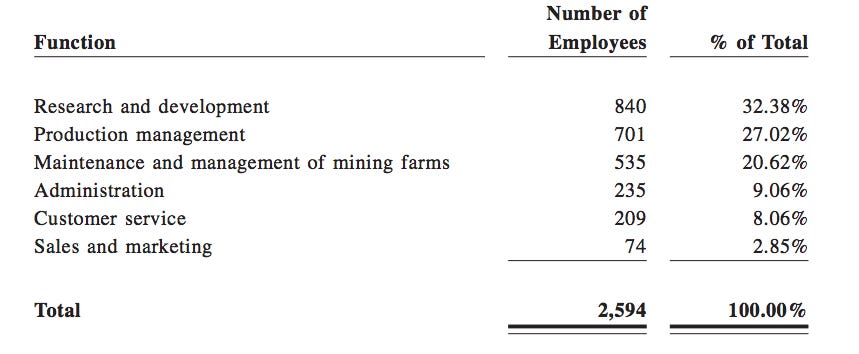

As of June of 2018, Bitmain was up to 840 (!!) full time engineers on their research and development team. That is ~30% of its entire team, making Bitmain a 2500+ person company. The focus for the engineering team: chip design, algorithm development, platform architecture, software, and hardware development.

On the marketing front, Bitmain states that they rely mostly on ‘word-of-mouth’ branding, as they have “only” a team of 74 people for sales and marketing. Full breakdown:

Not-so-fun fact: Bitmain does note it is a risk that none of their current employees are currently represented by labor unions.

ON BITMAIN’S STRATEGY & BUSINESS MODEL

Bitmain’s own customer base grew from 6,000 customers in 2015 to 80,000 customers in just the first six months of 2018. The 50-50 split between Chinese and international buyers has come down quite a bit as the company has pushed further internationally.

While the core of Bitmain’s business will likely continue to be the front end + back end design of their ASIC mining chips (and ancillary businesses), the company is also making a huge AI play via their new ASIC chips. Their targeted areas of focus: image identification, facial recognition, and big data analysis.

[TBI Note: During our Hong Kong trip, we heard that Bitmain was spending $1mm a month just with the *recruiting firm* that was helping them find AI-chip engineers. Just a staggering pace of growth and believable if you back-of-the-napkin things.]

TO CONCLUDE:

Tribal controversies aside, Bitmain is one hell of a company. From its inception in 2013 to today, it’s been an impressive growth story, and its IPO comes with a level of disclosures that we simply don’t get from other crypto companies.

Yet.

- Katherine @ Messari

P.S. Smash those share and subscribe buttons, and spread the love. Tweet at me or Messari for feedback, comments, or (more?) questions.

News & Analyses

Messari Compression Algorithm

Content and thoughts from around the web as summarized by the Messari team.

💱 U.S. judge sides with CFTC on cryptocurrency oversight.

A federal judge has ruled that "virtual currencies" meet the definition of a commodity and fall within the jurisdiction of the Commodity Futures Trading Commission (CFTC). The decision was made in the specific case of a lawsuit against Nevada-based My Big Coin Pay Inc, which the CFTC claims missapropriated $6 million from 28 customers they lured by naming their virtual currency to sound like bitcoin and further claiming it was backed by gold. The judge found that because the law defines commodities in broad categories rather than specific types or brands My Big Coin would fall into the definition. Furthermore, because My Big Coin and Bitcoin ($BTC) can both be broadly categorized as virtual currencies, and bitcoin futures currently trade on U.S. exchanges, the CFTC has oversight for virtual currencies according to the judge. (Messari | Source)

📖 [Analysis] A primer on Austrian economics - Erik Torenberg

The Austrian school of economics is tied closely to Bitcoin's separation of money and state despite originating nearly 100 years earlier. Austrian economics focuses on first principles, examining the choices made by individuals, not aggregate statistics from the collective. The Austrian school is often compared with the Keynesian or Chicago schools of economics. While Keynesians want to solve recessions by deploying government spending the Chicago school (or Monetarists, or Friedmanites) prefers monetary policy as a remedy. Austrians would argue for neither, as it is a free market school. The Austrian school believes that the printing of money by governments, usually as a response to the business cycle, leads to individuals spending or speculating more than they would with a hard money standard. This leads to speculative bubbles that in turn create recessions, which is what governments intend to avoid in the first place. Instead of printing new money Austrians believe the economy grows through investment, capital accumulation, and innovation. (Messari | Source)

📊 [Analysis] You Don’t Need a Diversified Crypto Portfolio: Here’s Why - Kenny Li

Bitcoin dominance is a popular data point created by ShapeShift CEO Erik Vorhees for measuring the market cap growth of bitcoin and altcoins relative to each other. While dominance and market cap are fair ideas, some dangerous misconceptions about cryptocurrency market behavior can come from relying on them too heavily. For example, the prices of most major cryptocurrencies demonstrate very strong correlation with bitcoin’s price and have so for years. Whether bitcoin’s price pumps or dumps, altcoins usually follow suit and to a much more severe degree. And diversifying a cryptocurrency investment portfolio to spread risk in a market filled with bitcoin-pegged cryptocurrencies is likely a futile endeavor. If anything, dominance undersells the material influence that bitcoin has over the cryptocurrency market. (Messari | Source)

Quick Bits (Don't read that, I read it for you)

Choke Points (Exchange News)

📇 Coinbase announces a new policy for listing tokens and will allow token projects to complete an application in order to get listed on the exchange. Applications will be subject to the exchange's normal evaluation framework and may include a fee in the future to defray legal costs. (Messari | Source)

📍 Circle launches USDC stablecoin. USDC will be immediately usable on Poloniex and Circle Trade with other exchanges like DigiFinex, CoinEx, KuCoin, and OKCoin. Wallets BitGo, Cobo, Coinbase Wallet, and imToken planning to integrate it in the future. Using Circle's platform users are able to deposit dollars from their bank account and receive an equal amount of ERC20 based USDC tokens. (Messari | Source)

Startup Signals (ICOs, Cryptos, and Startups)

💡 ConsenSys backed token project Grid+ has started to provide electricity to its first four customers in Texas. (Messari | Source)

🐜 Bitmain files IPO prospectus in Hong Kong. (Listen to it on Messari’s Apple Podcast here, Spotify here, Soundcloud here, and Google play here)

The Powers That Be (Legal/Reg/Policy)

🛑 Indian supreme court to decide on central bank crypto ban. The central bank has argued that the legal system does not define cryptocurrencies in the current format and that the people do not have a right to interfere with regulatory matters. (Messari | Source)

🕵🏾 U.S. government agencies have spent nearly $6 million tracking crypto usage. Unsurprisingly, the top spender among was the Internal Revenue Service (IRS). (Messari | Source)

Did I miss something?

Send me the link, your twitter handle and your best imitation compression algorithm write up. If I like it, I’ll include your bit next issue (with attribution).

Community Updates

Announcements

🎧 ICYMI, we also host & produce our own podcasts on Spotify, iTunes, and Google Play.

In our latest episode, we had on Eric Meltzer to talk about the latest bitcoin bug, and also give you the most interesting statistics about Bitmain's latest disclosure documents for its IPO application on the Hong Kong Stock Exchange.

Listen on Apple Podcasts here, Spotify here, Soundcloud here, and Google play here. Happy learning!

Shameless Plugs

We're Hiring:

We need data engineers who want to bring transparency to crypto!

Join a fast growing team in NYC; work with crypto OGs, and former Bloomberg/Palantir engineers; & access a network that sets you up for the rest of your career. Apply here!

Upcoming Travel:

Hit us up in these locations:

Crypto Springs, Palm Springs, October 3 & 4

EthSF, San Francisco, October 5-8th

DevCon, Prague, Czech Republic October 30–November 2, 2018

Join Our Community:

If you are interested in helping us crowdsource token project details, or want to join our community to share your expertise, wed love to have you on board! Take a second to fill out an application and we will get back to you soon.

Going forward, we’ll be capping new members at 15 each week to keep things running smoothly. If you haven’t heard back, you are probably in the queue.

Like what you read? Share it! Hate what you read? Let me know @MessariCrypto.