Your daily snapshot from our OnChainFX markets dashboard.

Quick note on the timestamp above…no, I’m not sending this email from the future, but I am six hours ahead of my other colleagues in NYC.

Ben and I have an action-packed schedule this week in Berlin, first at tonight’s Interoperability meetup at Fabric Ventures, then tomorrow (big announcement!) at Web 3 Summit, and then DappCon/ EthBerlin where I’ll be hopping on a couple of panels. If you want to say hello, we’ll be wearing our Messari tees. Come find us!

(Or hit us up on twitter: Ryan, Ben)

***

DEFIant!

We’re excited to be syndicating Camila’s Russo’s weekly “Defiant” post on all things Defi. It’s in keeping with our goal to curate the curators and save you time. This week’s top themes…

1. No Sign of Ether Short Sellers After Price Drop

Ether had an awful week, dropping below $200 for the first time since July, except this time, as opposed to one month ago, it didn’t bounce back above that level and kept falling. It was around $184 last time I checked. But traders aren’t betting on a further decline. (Read more)

2. DeFi Loans Continue Making New Records

Those looking at how total value locked in decentralized finance has been sliding since April (like myself last week), should keep in mind that’s not the whole picture. Loans outstanding have been making new records, with growth picking up in July, which was a record month for origination. (Read more)

3. Weak Hands May be Dragging Ether Down

Ethereum enthusiasts have been wrestling with the following question all year: With all the development and activity around Ethereum, why does the ether price keep sliding, especially when compared with bitcoin? Part of the answer may lie in the make up of ether holders. (Read more)

***

Finally, Binance Runs the Crypto World (But You Already Knew That)

Over the weekend, Binance announced plans to launch an "independent regional” stablecoin, something Binance co-founder, Yi He equated to a “One Belt One Road” version of Libra.

NLW breaks down what this means for the industry. In short, Venus aims to create "localized" versions of stablecoins built on top of Binance's blockchain and existing exchange infrastructure. It could be used in countries like China or India where Libra won’t be permitted to operate.

As NLW points out in this week’s Narrative Watch, Binance may be effectively blurring the line between “corporate” currencies, and “surveillance” currencies preferred by nation-states and their central banks.

(“Permissionless” - Bitcoin, Ether); “Corporate” - Libra, Venus; “Surveillance” (China, UK CMDCs)

Have a terrific week!

-TBI

P.S. Share. Subscribe. Spread the love. Tweet at me or Messari for requests, feedback, comments, or questions.

Best of the Boards

This week we are highlighting some of the best user generated boards from the past week. Build your own, tweet it, and tag us us for a chance to be featured next week!

Narrative Watch: CBDCS & the Non-Sovereign Fiat Wars - @nlw

Dive deeper on this weeks narrative watch with a collection of content from NLW including all the tweets, articles, and blogs about CBDCs and the Non-Sovereign fiat wars.

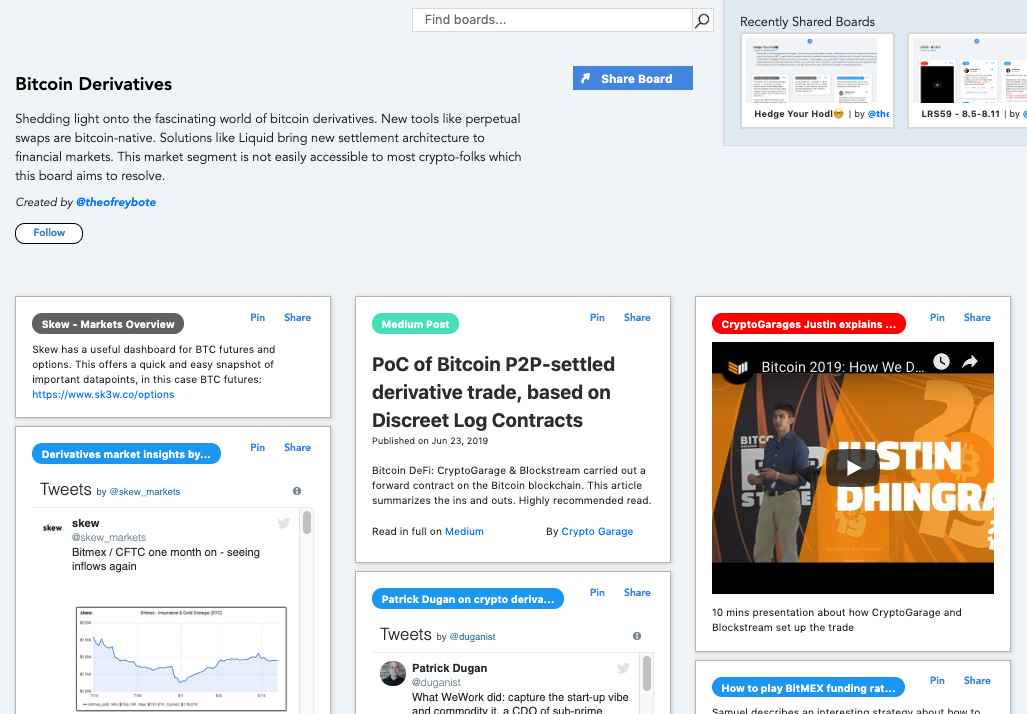

Bitcoin Derivatives - @theofreybote

This board sheds light onto the fascinating world of bitcoin derivatives. New tools like perpetual swaps are bitcoin-native. Solutions like Liquid bring new settlement architecture to financial markets. This market segment is not easily accessible to most crypto-folks which this board aims to resolve.

Every week we host an AMA with one of the projects on the Messari Registry. Keep track of all the conversations with this board that features links to all the transcripts.

Did I miss something?

Send me the link, your twitter handle and your best imitation compression algorithm write up. If I like it, I’ll include your bit next issue (with attribution).

Should your colleagues read daily? We now offer discounts for corporate access. Email us, and we’ll onboard your whole team.