CMC Doesn't Suck - Unqualified Opinions #4

Hidden inflation is a tricky, material, fundamental crypto metric.

Messari’s Unqualified Opinions Issue #4

TLDR:

As most of you know, we’ve been working for the past year to create simple, common-sense disclosures standards for ICO teams. If we accomplish one thing, I hope it’s the initial thing I set out to do last summer when the idea hit me - figure out what annual (often hidden) inflation is amongst the 2500 tokens (and counting) that people are throwing real money at.

Killer Regulatory App - Supply Curve Management

Just hopped out of the Davidson meetings down in DC, where in typical public policy fashion, I made the 7-hour roundtrip on a swampy day in the swamp to speak for two minutes in a public forum where most of the people in the room already knew my schtick. Such is life.

At least I met a couple of staffers. (I mean that seriously, they run the world.)

The trip down was a good opportunity for me to distill my thoughts on what we as an industry can do to incrementally improve disclosures (and thus, consumer and investor protections) in crypto, without saddling token teams with over-burdensome reporting standards.

I’ve got two decent thoughts so far. Things that are simple to grok and not overly difficult to implement:

1) We can build detailed supply curves that include event-driven disclosures for when new liquid tokens actually hit the market.

2) We can urge politicos to focus less on getting token creators to volunteer disclosures, and more on getting liquidity providers (exchanges) to demand transparency from the ICO teams they do business with (co-opt the choke points).

Let’s look at these one as a time.

One today. The other tomorrow.

Building Basic Token Supply Curves

Token treasury management sits somewhere on a spectrum between cap table management (how companies manage their equity), and natural resource management (how companies manage their commodities portfolio).

On the one hand, you have centrally issued tokens from a single creator, with predetermined, fixed total supplies and strategic reserves for key stakeholders like founders, an affiliated foundation, and key advisors.

Even if these assets fail the Howey test (aka not a security), distribution behaves much like their equity analogs, as you can model exactly when fresh supply is hitting the market according to programmatic vesting schedules and token project disclosures.

Let’s not even talk about burning, staking, mining, etc. mechanics that affect programmatic supply distribution (the commodities management side of things). Here are different forms of supply we know about from day 1 with respect to most ICOs:

What is sold to token sale purchasers and liquid

What is sold to token sale purchasers and illiquid (subject to vesting)

What is held in the project coffers that is liquid

What is held in the project’s coffers that is illiquid

What is earmarked for strategic distribution (rather than direct sale)

The line between what is liquid and simply held vs. what is illiquid and subject to vesting is difficult to ascertain at first glance. This makes things as basic as “market cap” difficult to track.

CZ and Binance aren’t the only ones dealing with this.

And CoinMarketCap - despite being a competitor to OnChainFx - doesn’t suck. Unclear circulating supply is the norm vs. the exception, and we can only fix that through a combination of blockchain transaction analyses and ICO team and investor disclosures.

Circulating supply is more than a mere input into a vanity metric like “market cap”, it’s the denominator you need to understand crypto’s hidden inflation. As new supply gets added to the mix, you can’t measure inflation/dilution if you don’t know what supply is already liquid. Moreover, you can’t monitor when an insider is “dumping” on the market unless you know which liquid balances move and they make the attestation.

In a speculators’ market, knowing about changes to supply is about as close as we’re going to get to fundamentals.

Let’s use Civic as an example, because I think they ran one of the cleanest token sales to date (single tier for all investors), had simple vesting schedules for their strategically reserved tokens, and made helpful first anniversary disclosures that they legally didn’t have to.

(Disclosure: I’m not talking about the merits of the $CVC token. I like Civic the company and Vinny the dude. While I was previously an investor in the company via DCG, I hold no $CVC, Civic equity or DCG equity, so have no direct or indirect exposure to the token. Vinny has been a supporter of our transparency efforts, though.)

Look at what a shit show supply/inflation tracking becomes with this “clean” example absent any standardized disclosures.

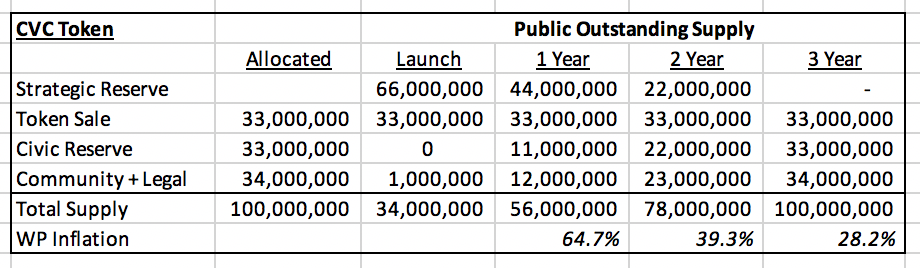

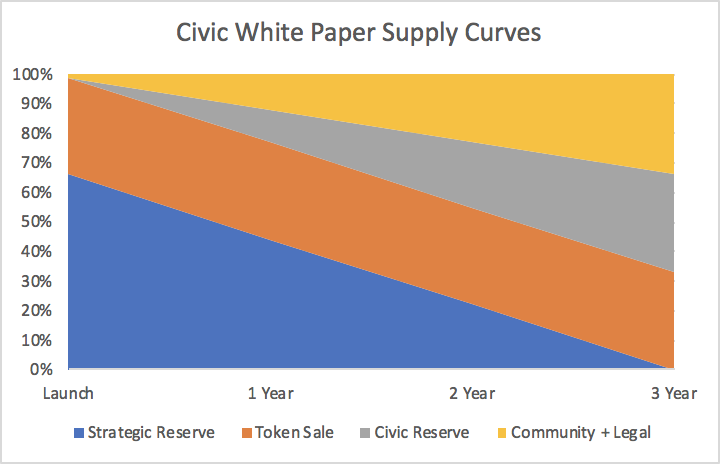

Here’s what Civic (the company) laid out in its white paper and token sale documents. They were selling a third of $CVC, keeping a third for the company (to satisfy their investors), and earmarking a third for strategic reserves (with the last point going to pay off legal bills). Easy peasy.

The company didn’t sell its vested tokens and laid out how most of its token treasury would remain on its balance sheet, and how they’d instead make disclosures around their secondary policies in due time.

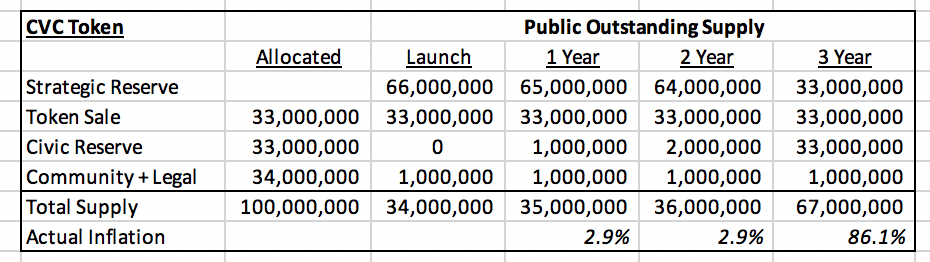

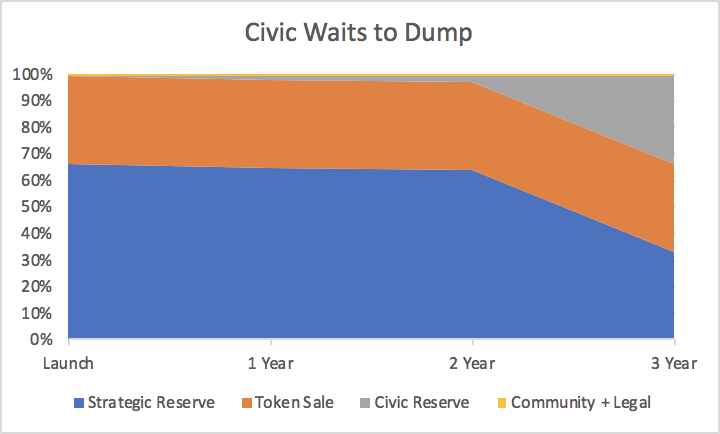

But if the company were run by exit scammers, they might do something like this and not tell anyone:

(*Internally*) “The market sucks right now. Let’s not distribute the community tokens. That will only depress the price. Instead, we'll wait for the next bubble to dump our stake and call it a day. We can hand things over to a foundation after that.”

There’s no legal need to disclose the actual timing of vested treasury tokens, whether in fire sale mode (this summer?) or amid a run-up in the next bubble (2020 mania in the example below). Remember $CVC will vest according the rules laid out in the 2017 token sale. Nothing prevents Civic, Inc. them from selling into the next rally and handing things over to a new foundation’s leadership team.

Something that looks like this, with 86% inflation (perhaps within a single week or month) as soon as they decide to unwind the position:

Let’s get back, though, to assuming good intentions, which I do in general, but in particular having known this company for a while.*

(*Ugh, yes, fodder for another post: this assumption alone should make it clear why Messari is building product that will disintermediate me and us from subjective calls.)

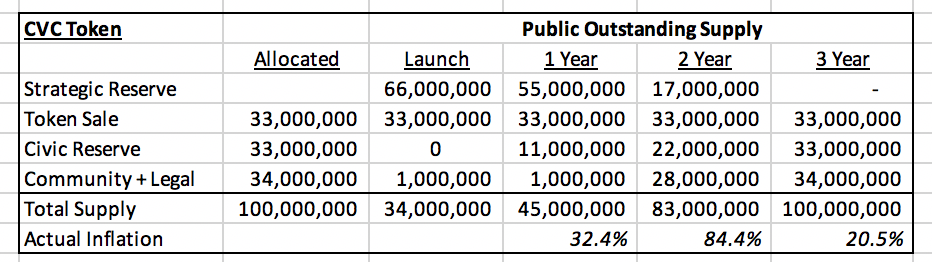

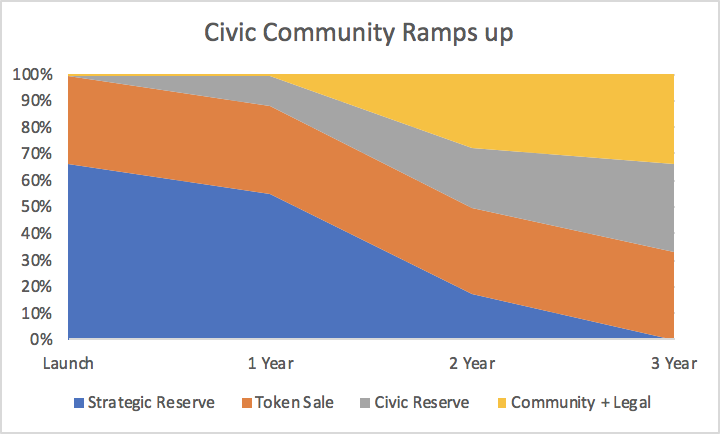

Say that Civic announces a major partnership, and maybe even buys a big KYC/AML company next year in exchange for $CVC tokens. They sell their reserve tokens as planned to dividend out to equity holders, but now they also burn a big chunk of their community reserve next year on M&A.

You probably want to know what restrictions are on the resale of the tokens used in the acquisition. Because otherwise you could have 84%+ inflation overnight.

This is the easy stuff from a straightforward project. 0-100%+ inflation that could technically hit the market at any time for any reason with no restrictions other than the goodwill of the founders.

That’s fucking scary, and it’s something we could easily and proactively address with regulators and legislators in DC and internationally.

One disclosure: when do insiders buy and sell?

You’re going to hear a lot more about this in the coming months as projects sell their reserves. The MakerDAO news yesterday drove home the point. (See compression algo below. (Don’t stop reading, you weak ass quitter.))

Maker is an interesting project, it was a great announcement to get a16z on board, but it wasn’t clear to the broader community where/when a16z purchased the tokens, how the terms of the deal were struck, and whether that investment would be illiquid for any period of time.

Circulating supply is an important, tricky metric to scrape, and some self-regulation would go a long way towards helping us gather the inputs we need to level the playing field between crypto funds and retail investors. Which - reading the tea leaves - is what the most pressing legal discussions today are really all about.

More on how to keep pro investors in check and prevent them from becoming too vampire-squid-y tomorrow.

I love this shit.

- TBI

P.S. Smash those share and subscribe buttons, and spread the love. Tweet at me or Messari for feedback, comments, or (more?) questions.

News & Analyses

Messari Compression Algorithm

Content and thoughts from around the web as summarized by the Messari team.

🤓 Here's what the Messari team was reading this weekend (Sep. 21, 2018)

Debunking market narratives: Litecoin ($LTC) edition - Multicoin Capital (editors note: seems like Litecoin received some research attention last week. Coinshares also published a report on the asset in their lastest reserach report, which can be downloaded here)

ERC-1404: Simple restricted token standard - TokenSoft

Tokenized assets and security token offerings are the future - Reza Jafery

Virtual markets integrity initiative - Office of the New York State Attorney General (editor’s note: we also summarized this report in last week’s newsletter here)

Statistical Fallacy behind the Lindy Effect - Qiao Wang

💰 Maker announces strategic purchase from a16z crypto. Stablecoin project MakerDAO announced earlier yesterday that a16z crypto, a fund run by Andreessen Horowitz, had purchased 6% of the total supply of MKR tokens. Maker highlighted that the $15 million investment would “give their team additional access to a16z's team and resources.” a16z and Polychain Capital led a similar purchase in December of last year when investors purchased $12 million of MKR tokens. (Messari | Source)

📢 Prominent crypto voices warn SEC on new products. Bitcoin Core developer Bryan Bishop, former Morgan Stanley managing director Caitlin Long, e-commerce coding pioneer Chris Allen, founder of Ernst & Young’s blockchain team Angus Champion de Crespigny, and fund manager attorney Gavin Fearey warned the SEC on practices employed by New York Stock Exchange (NYSE) owner ICE. At the center of the concern is the practice of pooling assets instead of segregating them by owner, a process know as commingling, and rehypothecation, which allows organizations to claim an asset on its balance sheet while lending it to another party. These practices could lead to a situation where there is more 'liquid' supply of an asset than what is actually held in accounts. (Messari | Source)

⛏️ [Summary] The ASIC Mining Race and Where It is Going— Mohamed Fouda. Mining is not just a way to make money but an essential and fundamental piece of any cryptocurrency. Miners act as a central bank in crypto networks by printing new money to release into the economy. As investors like VCs start to look at mining as a new way to participate and invest in networks it is important to understand the current state of mining technology. Application specific integrated chip (ASIC) technology has become the standard for miners on SHA256 blockchains like Bitcoin ($BTC). Now hardware manufacturers are looking to new chains and hashing algorithms to increase their market share. At the same time the chips that power these machines are become more advanced, offering increased power and profitability for miners. Mohamed Fouda believes that the increased spread of ASICs, and competition between manufacturers will benefit the ecosystem by driving down prices and delivering more efficient miners to market faster.

Quick Bits (Don't read that, I read it for you)

Choke Points (Exchange News)

🐻 California's Fair Political Practices Commission (FPPC) voted 3-1 to ban political donations made in cryptocurrencies. (Messari | Source)

🇧🇷 Brazil's largest brokerage, Grupo XP Guilherme Benchimol, plans to expand crypto exchange XDEX for Bitcoin and Ethereum trading in the coming months. (Messari | Source)

Coinbase has announced a new partnership with institutional crypto startup Caspian to provide order management, execution, compliance, and risk management tools for institutional investor on the Coinbase Prime platform. (Messari | Source)

Startup Signals (ICOs, Cryptos, and Startups)

🐜 Bitmain has announced its own next-generation SHA256 ASIC mining chip. While exact details have not been released, Bitmain claims the new 7nm chip will be more powerful and efficient, quoting a potential 42J/TH ratio of energy consumption to mining power making it approximately twice as efficient as Bitmain's current offering. (Messari | Source)

🆔 Crypto powered browser Brave announced that it has partnered with blockchain based identity provider Civic. Using Civic's identity services, publishers will be able to verify their details on Brave in order to claim their Basic Attention Tokens. (Messari | Source)

The Powers That Be (Legal/Reg/Policy)

🇺🇸 U.S. Congressman Rep. Tom Emmer to introduce three blockchain related bills that will focus on the regulatory aspects of the industry including consistent regulation, protections for crypto miners, and a safe harbor for taxpayers who receive cryptoassets from a network fork. (Messari | Source)

"Celebrities" (Crypto Influencers)

🏛️ Rep. Warren Davidson will host nearly 50 representatives at a roundtable in Washington D.C. today. Representatives will discuss a range of topics including consumer fraud protection, private funding disclosures, and token issuance laws. Representatives from Fidelity, State Street, Union Square Ventures, Andreessen Horowitz, Nasdaq, and the U.S. Chamber of Commerce are among those (including us!) confirmed to attend. (Messari | Source)

Did I miss something?

Send me the link, your twitter handle and your best imitation compression algorithm write up. If I like it, I’ll include your bit next issue (with attribution).

Community Updates

Announcements

🎧 ICYMI, we also host & produce our own podcasts on Spotify, iTunes, and Google Play.

In this past week’s episode, we had on Jake Chervinsky to provide a better & easier primer to understand the major U.S. (federal and state) regulatory agencies that relate to the crypto space. Agencies covered in this episode: SEC, CFTC, FINRA, FinCEN, OFAC, CFPB, OCC, NYDFS, and NYAG.

Listen on Apple Podcasts here, Spotify here, Soundcloud here, and Google play here. Happy learning!

Shameless Plugs

We're Hiring:

We need data engineers who want to bring transparency to crypto!

Join a fast growing team in NYC; work with crypto OGs, and former Bloomberg/Palantir engineers; & access a network that sets you up for the rest of your career. Apply here!

Upcoming Travel:

Hit us up in these locations:

Crypto Springs, Palm Springs, October 3 & 4

EthSF, San Francisco, October 5-8th

DevCon, Prague, Czech Republic October 30–November 2, 2018

Join Our Community:

If you are interested in helping us crowdsource token project details, or want to join our community to share your expertise, wed love to have you on board! Take a second to fill out an application and we will get back to you soon.

Going forward, we’ll be capping new members at 15 each week to keep things running smoothly. If you haven’t heard back, you are probably in the queue.

Like what you read? Share it! Hate what you read? Let me know @MessariCrypto.