Insights from the "States of Crypto" - Unqualified Opinions

coindesk, fabric ventures, ICO Rating, etc.

Note to “free” subscribers: We’ll be building, and researching, and evangelizing throughout this bear market, regardless of how long it lasts.

But we need your help to do it.

This week will be the last week you can subscribe to Unqualified Opinions at the rate of $15/month or $100/year. After that, we’ll be doubling fiat prices, and paywalling 80% of our research content to make it more sustainable and keep it uncorrupted by ads. Benefits to subscribing:

Daily insights and synthesis from a team that’s built through multiple crypto bear markets. Never miss a trend or new data point.

The warm and fuzzy feeling of paying for a service you like, when you know it’s getting reinvested in making crypto more transparent and ethical.

Preferred access to our invite-only meet-ups and monthly analyst calls.

Shout-outs in this newsletter (social signaling!) when you give the gift of a subscription this holiday season.

CoinDesk’s Q3 State of Blockchains report is out, and it reminded me of how direly this industry needs better contextualized and real-time research and markets info.

Old school research reports typically come out 6-8 weeks after the end of the quarter. Indeed, for Q3 we have…

CoinDesk: published 12/5

ICO Rating: published 11/15

Fabric Ventures: published 10/17

There’s been, ummm, a bit of change to the markets between the time period these reports cover and present day. Staleness aside, we wanted to curate the curators and provide some takeaways from each as well as a look ahead. Some stats and charts:

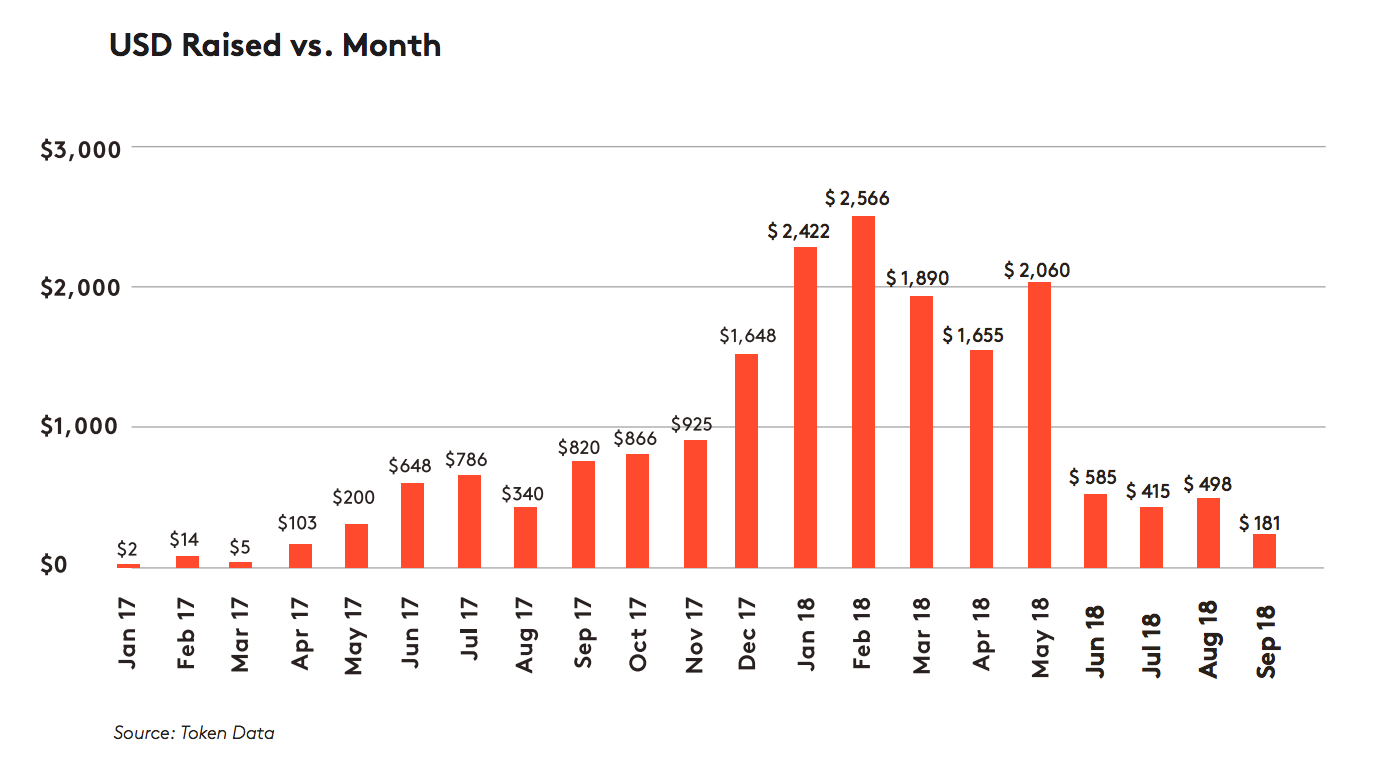

Fabric Ventures (citing Token Data): half of all token money raised in the first nine months of the year went to the top ten projects. Only 1/3 of tokens outperformed ETH and BTC (maybe that’s changed given ETH’s recent collapse).

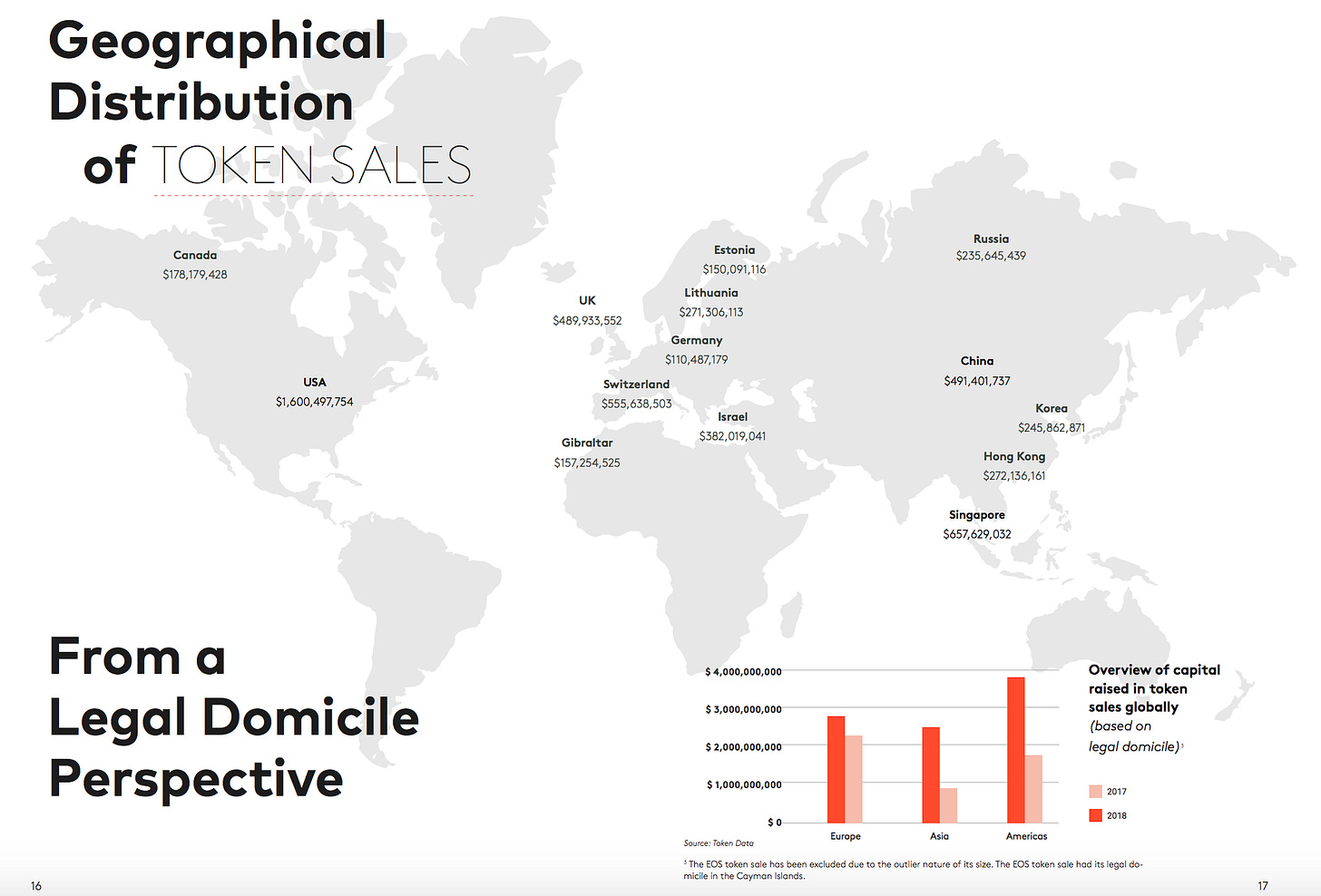

Same report from Fabric: interesting geographic and time series breakdown of funds raised. For this particular data, you aren’t missing much by not having October and November data. The Q3 token fundraising market was dying, and now it’s pretty much dead.

I found the geographic breakdown particularly useful as a reference point for thinking about regulatory arbitrage, and where teams’ might flock going forward.

Same report from Fabric shows just how f*cking nutty the bubble was. Maybe no surprise, but 83% of token sales teams spun up their github repos less than six months prior to the sale. (Nothing to see here! Literally!)

And those commits (surprise, surprise) spiked just prior to sales, and then plummeted, for both successful and unsuccessful fundraises alike.

Moving on to the ICO Rating report: “76.15% of all the projects in Q3 had nothing but an idea before launching an ICO. Compared with Q2, the number of projects aiming to attract funds at the idea stage increased by 18.72%.”

Same ICO Rating report: the path to liquidity and big exits got decidedly bleaker (or people stopped simply setting their investment dollars on fire). Only 24 new tokens were listed on exchanges.

Same ICO Rating report: a more detailed geographic distribution of sales specific to Q3 (Fabric’s referenced the first nine months). I didn’t expect to see Russia as the leader in the clubhouse in both dollars raised and number of projects, but North America made up just 13% of all activity:

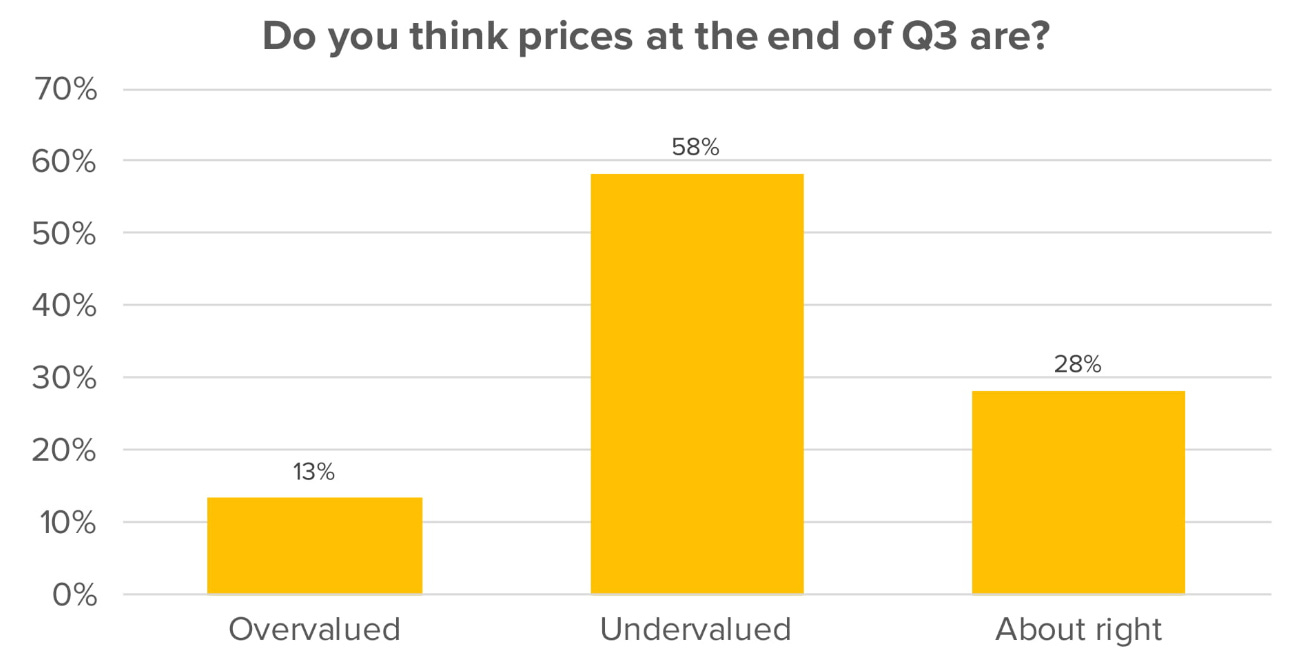

Same ICO Rating Report: Maybe most concerning for 2019, in Q3, the median return from tokens was 3.35%, 79% of tokens were traded below the ICO price. “When Binance?” is not such a funny meme anymore. There’s a lot of completely f*cked and illiquid token holders regretting those SAFT terms they signed up for.

And finally, from CoinDesk: This bitcoin hash rate chart tells a scary story that hints at the massive pain most mining companies are experiencing right now. Not only are prices down, but aggressive capital expenditures were thrown at new mining capacity throughout the first half of the year, and the payoff on those assets will be pretty close to nil.

Next quarter could be the first negative difficulty quarter in a long time (ever? I didn’t have time to double check - would appreciate a reader bailout and give examples of other quarter-long PoW difficulty corrections BTC or elsewhere). It’s the first at-global scale crypto correction for most of the unicorn-sized miners including Bitmain and Bitfury. (What happens if big corporate miners go bankrupt? How bad could the difficulty correction get?)

From CoinDesk: One of the only metrics that doesn’t really make you want to cry into your pillow at night is the pace of VC investment in infrastructure and picks and shovels companies. And that has exploded. Thank god not everyone raised funds in a hedge fund structure with redemption rights. These mega funds deployed a record amount in Q3 that should (hopefully) bear healthy long-term fruit.

One bit of good news for everyone (except token intoxicated entrepreneurs) is that those valuations are also coming down, lowest average since Q1’17.

I promise you, I just spent 2.5 hours skimming these reports for some pretty thin takeaways. You’re all caught up now.

See you tomorrow.

-TBI

P.S. Where do you turn for reliable research and data? We want to know, so we can use them and fold them into our rapidly evolving crypto intelligence system. (Soon.)

P.P.S. Share. Subscribe. Spread the (rational) crypto love. Tweet at Messari for requests, feedback, comments, or questions.

News & Analyses

Messari Compression Algorithm

Content and thoughts from around the web as summarized by the Messari team.

🤔 [Analysis] The “Bitcoin mining death spiral” debate explained – Arjun Balaji

Arjun argues that Bitcoin is not going into a “mining death spiral.” The death spiral argument goes as follows: Bitcoin prices plummet; marginally profitable miners shut off and 100% of mining rewards get sold to cover costs; block times slow and make the network insecure. Ad infinitum, until all the miners are gone and no one mines Bitcoin. Arjun says that in an extremely unlikely scenario that hash rate dropped *a lot*, miners could be kept running by increasing transaction fees. If that didn’t work, there could be an emergency hard fork to manually lower difficulty. (Messari | Source)

⛄️ [Analysis] Why this crypto winter will be worse than 2014's – Dovey Wan

There are signs this crypto winter could be worse than the last. Bitmain failing in an IPO or performing poorly post-IPO would be a strong bear signal indicating even the most profitable player in crypto isn't accepted in capital markets. Many of the highly anticipated projects who raised a ton of money will launch their mainnets in 2019, most will fail to meet expectations, all have to compete with the tiny group of dapp devs. Many devs in the space noticed the basic infrastructure is incomplete, and protocol is not solving immediate user pain-points or creating new demand. Dovey says the current mining crisis is the worst since 2011, due to the “hash rate bubble” of 2017 and institutional buyers’ entrance is still far off. The market is highly trading/speculation centric, and unlike typical startup environment, all crypto assets are highly correlated. (Messari | Source)

Quick Bits (Don't read that, I read it for you)

Choke Points (Exchange News)

💰 Since the start of 2018, Grayscale, owned by Digital Currency Group (DCG), has seen its bitcoin holdings swell to 203,000 BTC total, now accounting for more than 1 percent of the asset’s total circulating supply. The overall performance of Grayscale funds have gotten hammered along with the rest of the market. (Messari | Source)

📢 Binance has released a demo of its decentralized exchange, Binance DEX, ahead of its launch in early 2019. The video demonstrates the trading interface along with a web crypto wallet and explorer for Binance’s native blockchain, Binance Chain, which the firm says will be made available on a testnet soon. (Messari | Source)

Startup Signals (ICOs, Cryptos, and Startups)

👋 Ryan Zurrer, the former number two at Polychain Capital, left the firm in recent months amid poor 2018 performance. Zurrer was a key early player at Polychain, which at one point managed $1 billion. (Messari | Source)

💵 Distributed ledger technology provider R3 has launched the Corda Settler, an application aimed to facilitate global cryptocurrency payments within enterprise blockchains. The first cryptocurrency will be XRP. (Messari | Source)

The Powers That Be (Legal/Reg/Policy)

🇪🇺 Seven southern EU member states including France, Italy, Spain and Malta are positioning themselves as Europe’s leaders on developing blockchain technology to be used by governments. (Messari | Source)

Did I miss something?

Send me the link, your twitter handle and your best imitation compression algorithm write up. If I like it, I’ll include your bit next issue (with attribution).

Podcast Recap

🎧 ICYMI on the Messari podcast, This week, Katherine sat down with Messari’s own Dan McArdle to talk about the recent downturn in crypto markets. Dan shared his thoughts on what is now the fourth "crypto recession" for him, and where he thinks things might head in the short to medium term.

Listen and subscribe to all of our podcasts— on Apple Podcasts here, Spotify here, and Google play here.

Shameless Plugs

We want your feedback!

We know Messari can feel like a couple different products right now, and we're working to unify our features into one overarching whole. To that end, We’ve made a Trello board to take in any and all of the feedback you have for us! Have at it 🛠

We're Hiring:

We need data engineers who want to bring transparency to crypto!

Join a fast growing team in NYC; work with crypto OGs, and former Bloomberg/Palantir engineers; & access a network that sets you up for the rest of your career. Apply here!

Join Our Community:

If you are interested in helping us crowdsource token project details, or want to join our community to share your expertise, we’d love to have you on board! Take a second to fill out an application and we will get back to you soon.

Going forward, we’ll be capping new members at 15 each week to keep things running smoothly. If you haven’t heard back, you are probably in the queue.

Like what you read? Share it! Hate what you read? Let me know @MessariCrypto.