Kik starting a pro-growth US crypto climate - Unqualified Opinions

and fighting an outdated regulatory regime

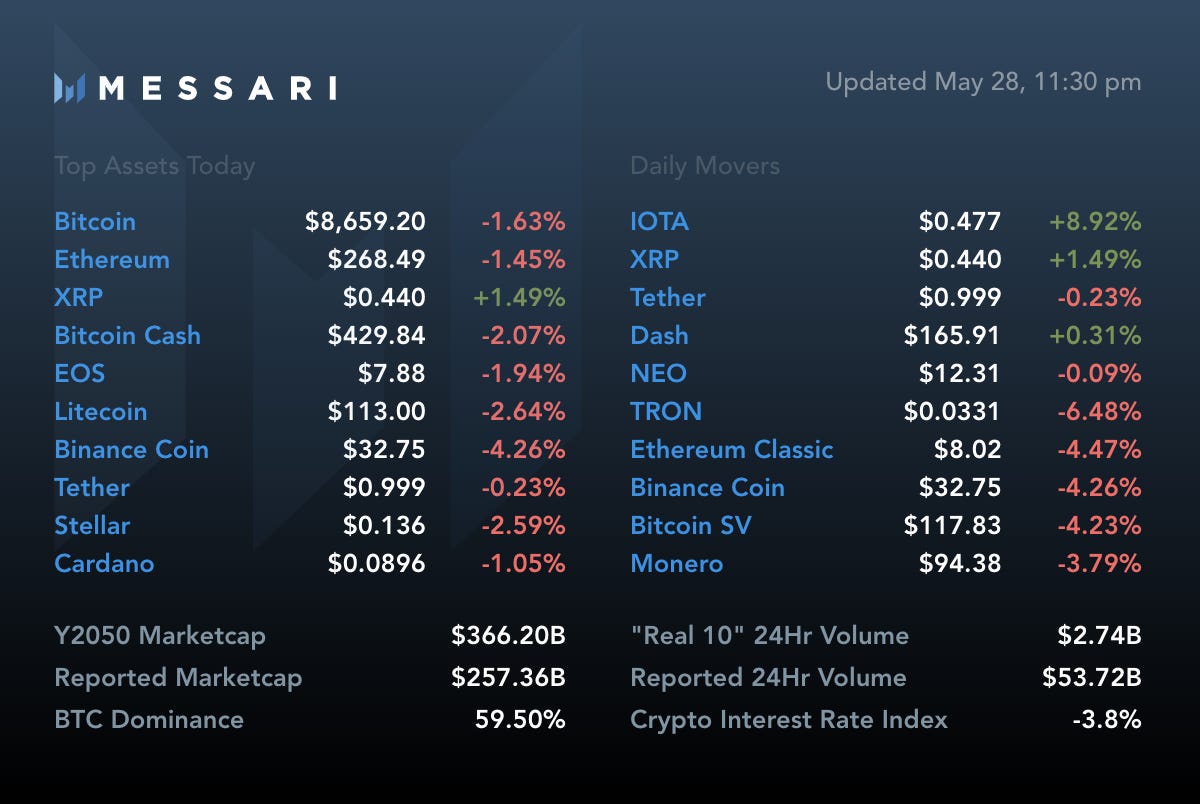

Your daily snapshot from our OnChainFX markets dashboard.

This is a free version of our daily newsletter, and it’s a big one re Kik/Kin vs. the SEC.

Join 500+ other subscribers for the daily dose of crypto goods. Including a new post on the IEO market tomorrow.

Kik Starting a Pro-Growth US Crypto Climate

As we wrote two weeks ago, Canadian messaging startup Kik has decided to confront the SEC in court regarding the Commission’s proposed enforcement action against the company and its affiliated foundation for their $100 million KIN token sale.

Today, the Kin Foundation announced a new initiative and fund to "Defend Crypto”, and said it's earmarked $5 million to fund a court battle against the SEC. That’s in addition to the $5 million they already claim to have spent. The goal, according to Kik CEO and Kin Foundation founder Ted Livingston, is to force the SEC to provide clarity on its positions surrounding token sales.

We’re proud to support the Kin Foundation and the Defend Crypto initiative, together with Circle, Coinbase, and ShapeShift. (Fred Wilson also seemed pretty fiery today on AVC re the topic.)

A new court case (should the Commission actually press forward with an enforcement action) would set legal precedent for token sales that have more relevance for the new digital economy than the 73 year old “Howey Test” (which was about orange groves).

That’s a great thing!

That’s also why we wanted to share our detailed view on why this is so important for the industry. Moreover, why the fight is consistent with one we’ve been waging since late 2017: towards a common-sense but innovator-friendly set of crypto regulations.

First, Some Quick Context...

Messari was born during the height of ICO mania in late 2017.

Dan and I looked around at some of the weekly, then daily, shenanigans taking place with token sales, and knew the excesses would lead to a vicious 2018 hangover.

We were so convinced about the coming crash, we spoke with investors and lawyers about spinning up a short / activist fund as part of the Messari fundraise. We ultimately opted against the vampire squid route, and chose instead to tackle the long-term challenge of promoting token team transparency, better reference data, and smarter governance. Things we knew were required before our short fund strategy would have actually worked as envisioned, anyway.

In late October, we introduced the idea behind Messari (or at least, phase one of Messari): an open-source EDGAR-like data library for crypto assets.

I wrote at the time:

“There are neither legal nor social contracts that require the big fund managers to disclose when they are selling stakes in their positions — and there are generally no lock-up periods.

There are neither legal nor social contracts within the industry for influencers or promoters to disclose their advisory or personal investment positions within crypto.

There are neither legal nor social contracts that dictate how a new token project should sell its token “treasury” over time, or behave if its founding team defects and leaves a shell entity with $500mm worth of bitcoin and ether and token tote bags sitting on its balance sheet.

Even pro-industry innovations in regulation like the SAFT may inadvertently add to the mania, as such an instrument gives possible legal cover to professional investors whose livelihoods rely on calculated speculation.

I think we’ve gotten so excited about the 10 year plans for crypto that we’ve neglected the short-term risks of our collective behavior.

If we don’t do a better job of self-regulating and creating some foundational social contracts in cryptoasset sales and trading, there will be no adults in this industry that deserve a seat at the table when the new laws and regulations are written."

Less than three weeks later, on November 8, I joked that SEC commissioner Jay Clayton had essentially raised our seed round for us with his comments at the Annual Institute on Securities Regulation in New York.

It was as close to a spot on match to our intro post as you could get from a regulator. And this came straight from the top.

Clayton’s short remarks are worth reading in full, but the cliff notes were:

+ The Commission is tasked with rulemaking for securities markets, but it is woefully under-resourced to tackle such a wide range of challenges, particularly in frontier markets like crypto. Instead, the name of the game is “regulatory proportionality.”

+ Clayton acknowledged that - practical limitations aside -regulation via enforcement was problematic, and instead asked whether there were “opportunities to defer, mitigate, or eliminate wrongdoing before an enforcement action becomes necessary.” He pointed to transparency efforts as one potential solution “to fight the type of opacity that can create an environment conducive to misconduct.”

+ Addressing token sales in particular, he noted many of the issues we highlighted in our inaugural Messari post: the dearth of structured information behind token sales, token price manipulation, and the lack of lock-ups for insiders. He explained the SEC was most concerned with what protections were “in place for market integrity and investor protection.”

Bingo.

Messari’s Trajectory vs. the SEC’s

As regular readers will know, Messari’s been making great strides in its mission to promote transparency and smarter decision making in crypto ever since Chairman' Clayton’s long ago speech.

We’ve added 35 global (announced) projects in our voluntary disclosures initiative in the six months since we officially launched. Another dozen commitments will be announced in the next six to eight weeks.

The industry *is* self-regulating via transparency these days. You just need to know where to look.

The projects on our registry are doing exactly what the SEC had hoped for: promoting fair markets with a more level information playing field, and (in aggregate) protecting investors from getting duped by having a third-party validate their claims.

Our members are making it easy for their community stakeholders to understand their token’s economics, history, key contributors, real partners and investors, private and public sale details, ongoing supply schedule and token treasury management, product roadmap; and pushing that information out as broadly and consistently as possible.

It didn’t take a fear of regulators to help these asset creators realize their communities could benefit greatly from the creation of a single source of truth around some basic token details and underlying value drivers. Particularly in a market where the underlying assets trade cross border; with vastly different technical, governance, and economic structures; and often without most of the clear properties of a bona fide security (claim to a real asset or cash flow stream).

On the contrary, many recognized they could communicate through us at least as or more effectively than they could through a mere EDGAR filing because we’d capture the basics of their tokens and help them keep the details up-to-date in a more usable and ubiquitous interface (at least in the crypto markets).

Some projects are pursuing both Reg A+ offerings and participating in our registry, not because it’s necessarily the sensible thing to do, but because it’s unclear what’s required at all. (God help them.) But that’s expensive because the SEC moves at a glacial, uncertain, and uncompetitive pace. And when they do, it’s normally on the enforcement side.

No ETFs, Reg A+ offerings, or S-1’s have been approved to date despite tens of millions of dollars worth of aggregate legal bills. Nor do any seem likely to gain approval near-term.

On the other hand, there have been multiple SEC enforcement actions levied against token sellers to date. All were privately settled (who’s nuts enough to fight the SEC?), and most honestly seemed like smart settlements around egregious instances of investor fraud or malfeasance. That’s opposed to the mere fast and loose unregistered securities offerings that are still being investigated.

There have been no precedent-setting cases like Kin’s who now seems positioned to actively challenge the SEC openly and from a position of strength.

We liked that.

Working with Kin

Before I go on, it’s worth noting that supporting Kin in its legal fight is not a knock on the fine folks at the SEC themselves. Or a promotion of the Kin token itself.

We empathize with many of the SEC staff, who have had to grapple with all of the challenges Chairman Clayton identified in late 2017, while still picking obviously winnable fights (to set good precedent), and assessing what to do with such a rapidly evolving technical and legal landscape.

The fight isn’t with the folks on the front-lines. It’s with the institution itself and the ridiculous system it’s created that forces token entrepreneurs to choose between 1) restricting retail token users in the United States, 2) registering as a security, or 3) having many millions of dollars worth of financial resources to battle back and set new case precedent.

Kin is a perfect early foil because they’re the rare project with the resources and product urgency (Kin doesn’t work as a security token) to choose door #3.

1) The timing is good. The “Defend Crypto” movement comes just weeks after one SEC Commissioner signaled frustration with the Commission’s crypto policy, and even joked about their stodginess it at a crypto industry gala. It’s starting to seem obvious both inside and outside the SEC that the Commission likely cannot and should not pursue hundreds of enforcement actions against 2017 token teams before they set some type of common sense transparency guidelines for U.S. token teams. (We’re happy to help on that front.)

2) Kin’s counter to the SEC’s “Wells Notice” is a fun read. They call out the Commission’s earlier acknowledgment that “ether was probably not a security,” then compare Kin’s feature set and decentralization to ETH’s. They cite usability and good faith efforts of Kik to use the token to enhance its feature set and competitiveness of their business. They poke logical holes in most facets of the SEC’s Howey case. They pit themselves against actual data monopolies like Facebook and Google.

3) Last but not least, Kin is working with our research team on a disclosures profile. We’d be exposed to real reputational risk if we backed the project publicly, then published incomplete or misleading information. Conversely, we’d kick them off the registry if they failed to live up to their disclosures promises or misled us or their investors. Said another way, they’ve opted into the standards we set last year. Ones we think more teams should consider.

There’s a temptation for readers to read this and think: “wait. you’re just writing this because Kin is a partner now?”

To which I would respond: “uhh, yes.”

Candidly, there’s no way we could support this initiative if we didn’t believe the organizer was working to be more effectively transparent and act in good faith on behalf of its own users, investors, and the broader crypto community.

We know Kik/Kin are looking out for their own interests in this legal campaign, but it’s our role to help validate their disclosures, and we will. Because we know that now more than ever, the crypto industry can and must do a better job self-regulating.

We look forward to supporting any team that opts for transparency. And when it comes to “defending crypto” there is strength in numbers and common sense.

-TBI

P.S. Share. Subscribe. Spread the (rational) crypto love. Tweet at me or Messari for requests, feedback, comments, or questions.

Best of the Boards

This week we are highlighting some resources that can help you learn about important topics in crypto. Build your own board, tweet it, and tag us us for a chance to be featured next week!

Generalized mining is defined as "any supply-side service provided by a third party to a decentralized network in exchange for compensation allocated by the network” according to Jake Brukhman. Learn more about the projects, organizations, and concepts behind the space with this board.

A 51% attack is when one person or group gains more than half of a blockchain’s resources (hash power in PoW, tokens in PoS) in order to reverse a transaction. This board explains how they work and gives some examples of past attacks.

An airdrop is a means to distribute a cryptoasset to a wide audience in order to spur initial engagement. While they are distributed for free, they can still act as a source of funding for founding teams who can control a certain percentage of the tokens and subsequently sell them once there is liquidity. Check out this board to learn more about the technical and regulatory issues surrounding airdrops.

Did I miss something?

Send me the link, your twitter handle and your best imitation compression algorithm write up. If I like it, I’ll include your bit next issue (with attribution).

Should your colleagues read daily? We now offer discounts for corporate access. Email us, and we’ll onboard your whole team.