TL;DR:

In the coming weeks we’ll be rolling out a series of new features called Leveling Up, where we share our field notes from the team trainings (and happy hours) where we try out new crypto products.

So far we’ve done sessions on Augur, Lightning, Decentraland, and a barebones TCR. The series will offer an inside look at what it’s like to work at Messari. These sessions are one of my favorite parts about the company and our insanely curious team. Sounds fun, right? What should we tinker with next?

Speaking of Augur…

Our friends at Circle Research dropped a solid 27 page report on prediction markets earlier today.

That just so happens to coincide with two interesting posts from our community analysts regarding Augur’s REP and its potential valuation.

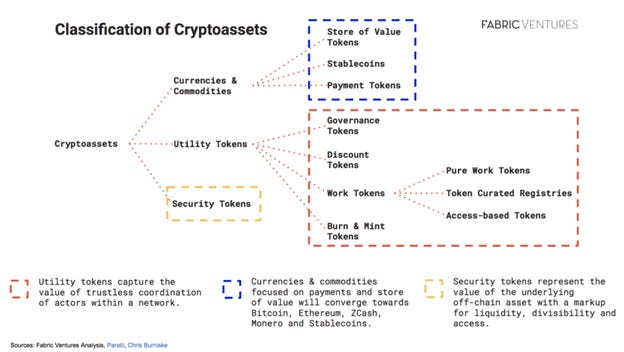

For the uninitiated, the REP token in Augur can be classified as a “work token.” That is, in order to provide services on the platform — primarily the ability to report the outcome of Augur markets, and to resolve disputes when they arise with reference data— users must own REP, of which there is a finite supply.

In return for validation services, REP token holders receive a pro-rata portion of the fees generated from any given market, kind of like a Vegas rake. There’s some overlap between how you might value a casino license, a “work token”, and a…taxi medallion?

Community analyst Jack Purdy took a closer look at this analog in a recent post that ties in a previous model from another analyst Phil Bonello.

You can read about Augur and a growing list of other projects in our Agora library.

-Eric & the Messari Team

P.S. Share. Subscribe. Spread the (rational) crypto love. Tweet at Messari for requests, feedback, comments, or questions.

P.P.S. As always, if you’re interested in helping crowdsource token project details, or want to join our community to share your expertise, we would love to have you! Take a second to fill out an application with your details and we will get back to you soon.

News & Analyses

Messari Compression Algorithm

Content and thoughts from around the web as summarized by the Messari team.

🔵 [Analysis] The synergies gained from building on Ethereum's decentralized app ecosystem – Preethi Kasireddy

Preethi argues that Ethereum's decentralized app ecosystem greatly benefits from indirect network effects between the Ethereum platform and all the apps built on top of it. Every new ETH user creates more demand for dApps, which in turn creates a greater variety of dApps. The decentralized and permissionless nature of Ethereum allows dApps to integrate with each other seamlessly as they share the same single standard, creating an ever tighter web. The flip side: it’s harder to build giant businesses off direct network effects on Ethereum. Maybe that’s a good thing.

🌗 [Analysis] Partially decentralized organizations – Matt Lockyer

Matt Lockyer believes “partially decentralized organizations”, (PDOs) are the best architecture for blockchain-based projects and startups because:

The technology is not ready for prime time despite the innovations being made

Web 3.0 should be released incrementally to ensure good user experiences

Existing institutions can help companies get to market faster

Jumping directly to a completely decentralized world with no governments and pseudo-anonymous and autonomous corporations, would be a bit of a shocker. Over time, however, as more value is transacted online, thinner and less bureaucratic institutions will rise and prevail.

Quick Bits (Don't read that, I read it for you)

Choke Points (Exchange News)

😠 In responding to charges leveled by an anonymous blogger on Medium last month, Arthur Hayes, the CEO and co-founder of BitMEX, said his platform doesn’t offer “special access to anyone,” doesn’t trade against its customers, and doesn’t make money when customer trades are liquidated. (Messari | Source)

🐢 Three weeks after Bitfinex assured users that withdrawals are processing as usual, users are still saying they haven't received their money despite the long wait. The exchange has been responsive to complaints but this has not necessarily translated into users getting their funds. (Messari | Source)

Startup Signals (ICOs, Cryptos, and Startups)

🗓 Developers are eyeing Jan 16 as the date on which Constantinople, Ethereum's upcoming network hard fork, could launch. While the Jan. 16 date was reached by way of a non-binding verbal agreement, it's not fixed or final. (Messari | Source)

💤 Mentions of “blockchain” in corporate earnings calls and presentations have fallen as much as 80 percent. At the peak earlier this year, “blockchain” was mentioned 173 times, according to an analysis of company transcripts by Axios, but the number has fallen to 35 in Nov. (Messari | Source)

The Powers That Be (Legal/Reg/Policy)

👨⚖️ Attorneys for Ripple Labs and its affiliated defendants filed to move a consolidated class-action lawsuit from its previous venue at the San Mateo Superior Court to the U.S. District Court according to court documents published Wednesday. The plaintiffs are also asking for Ripple to pay $167.7 million in damages claiming that “thousands” lost money. (Messari | Source)

🏔 Colorado regulators took action against four ICOs on Thursday, bringing the state's total number of cease-and-desist orders against crypto startups to 12. The state's “ICO Task Force” rebuked Bitcoin Investments, Ltd, PinkDate, Prisma and Clear Shop Vision Ltd. (Messari | Source)

Did I miss something?

Send me the link, your twitter handle and your best imitation compression algorithm write up. If I like it, I’ll include your bit next issue (with attribution).

Podcast Recap

🎧 ICYMI on the Messari podcast, Katherine breaks down the latest SEC order against EtherDelta’s founder, and what its implications are for DEX broadly (more in the Quick Bits as well). We also talk to Simon Taylor, founder of Global Digital Finance, about the importance of building a knowledge base and setting best practices for the crypto industry. (Ryan is an advisory board member, and Messari is a big supporter.) (17 min for your evening commute.)

Listen and subscribe to all of our podcasts— on Apple Podcasts here, Spotify here, and Google play here.

Some other great episodes are #12 (Erik Voorhees & Ari Paul at DevCon), #10 (Spencer Bogart on fund performance and tokenization), #9 (Tony Sheng on his writing process), #6 (Jake Chervinsky’s primer on federal & state crypto regulators), #4 (Nic Carter on data integrity in crypto), and #8 (Conversations on the ground at CryptoSprings).

Find our podcast series on Apple here, Google Play here, and Spotify here.

Shameless Plugs

We want your feedback!

We know Messari can feel like a couple different products right now, and we're working to unify our features into one overarching whole. To that end, We’ve made a Trello board to take in any and all of the feedback you have for us! Have at it 🛠

We're Hiring:

We need data engineers who want to bring transparency to crypto!

Join a fast growing team in NYC; work with crypto OGs, and former Bloomberg/Palantir engineers; & access a network that sets you up for the rest of your career. Apply here!

Upcoming Travel:

Hit us up in these locations:

Consensus Invest, New York, New York | November 28

Join Our Community:

If you are interested in helping us crowdsource token project details, or want to join our community to share your expertise, we’d love to have you on board! Take a second to fill out an application and we will get back to you soon.

Going forward, we’ll be capping new members at 15 each week to keep things running smoothly. If you haven’t heard back, you are probably in the queue.

Like what you read? Share it! Hate what you read? Let me know @MessariCrypto.