Your daily snapshot from our OnChainFX markets dashboard.

Good morning!

Lots of exciting posts teed up this week. From dissident tech and why it's good crypto is boring (before it’s not). To Zcash and its major new coming developments and political resolutions. To my book recommendations for the year (i.e. all the books I bought but didn’t read.)

For today, though…someone leaked our pitch deck over the weekend!

They conveniently tagged all crypto media in a mini-thread with all the slide screenshots and the claim they were our “fans”, even though they purposely misspelled our company name and didn’t tag us. I suppose so that it would be harder for us to find the tweets?

There’s nothing overly sensitive in there, though. So we released it over the weekend on slideshare for all to enjoy.

For today, I’ll go a step further and annotate the deck for your enjoyment (and for our selfish reasons) because:

a) We got lots of VC feedback, but we’d love community feedback!

b) Many of the insights we shared throughout the pitch narrative track to theses you might be interested to know are mine.

c) This is a good, complementary post to my guest write up for Pomp on Friday.

Of course, this is one deck for one company, and the ideal deck for your business is probably structured very differently.

I share it, though, because I think it’s a great deck (h/t Ben O’Neill) and probably took ~250 hours of cumulative hours to polish over a multi-month period. Might as well get one more mile out of it before we retire it for good. (For those wondering, I raised $2mm in 2018 without a deck. So nothing to compare this to.)

Here we go!

Opening slide:

Goals: Show purpose, company one liner (at the time), tease of the product

We’re raising money for our crypto data and research company.

No frills here, we wanted to set the tone for the meetings, and this was where I would spend time on my backstory and the company’s before diving in to the real pitch. This intro was the style I was most comfortable with because it’s more conversational, helped me establish credibility without an opening slide all about me, and flows well into the “formal” pitch.

I know some VCs will jump around frenetically during a pitch, but I’ve found that’s not usually the case with a tightly scripted narrative. To the extent they interject, 90% of the time, it’s a leading question for something that is answered in the next slide or two. It’s always nice when someone you’re pitching does the slide transitions for you.

Slide #1

Goals: Show big future market, historical parallels, and a path for skeptics.

If crypto really is the "internet of value" it’s about more than just currency.

This one was important. We were pitching crypto funds and non crypto funds alike. The non-crypto funds needed something to latch on to beyond bitcoin if they were more excited about “blockchain”, while the crypto funds needed to get excited about the "asset class” play.

We called this our "great filter” slide both internally and in meetings. If you don’t buy that this thesis has a chance of playing out, you’re not going to be interested in backing our company, so we can keep things short.

Slide #2

Goals: Show breadth of problem, which requires a broad platform solution.

What data/information do we need if the market is to mature to that $10 trillion size?

We were able to highlight the work that our team had done uncovering sizable errors in calculating circulating and future supplies, market caps, and trading volumes, plus speak to some of my / our bona fides as research curators that were pretty good at filtering through bullshit and noise.

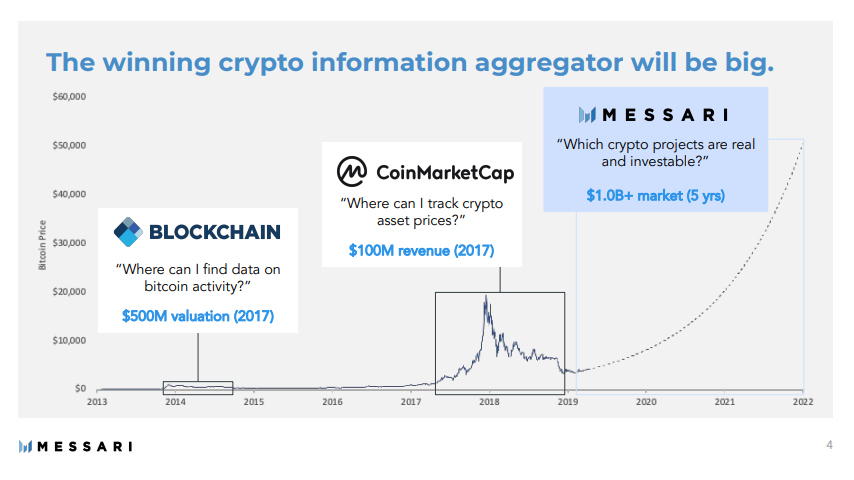

Slide #3

Goals: Show scale of comps (real $$$), embrace the crypto market cycle.

There’s been a major winner in crypto’s previous two bull cycles. Who’s next?

This was our money slide.

We postponed our fundraise until the Q4 2018 bleeding had stopped, but still entered fundraising in a bear cycle. The narrative that worked (and that I believe in) is that there will be four major four year cycles. The first two spawned massive data businesses: Blockchain started out as data and resources for developers and bitcoin hobbyists; CMC became the dominant platform for retail speculators; in 2021 there would be an emergent option for crypto professionals; and in 2025, you’d have data giants serving the enterprise market.

No way we were about to skip straight from retail shitcoiners to JPMorgan. There was a middle step that we were addressing.

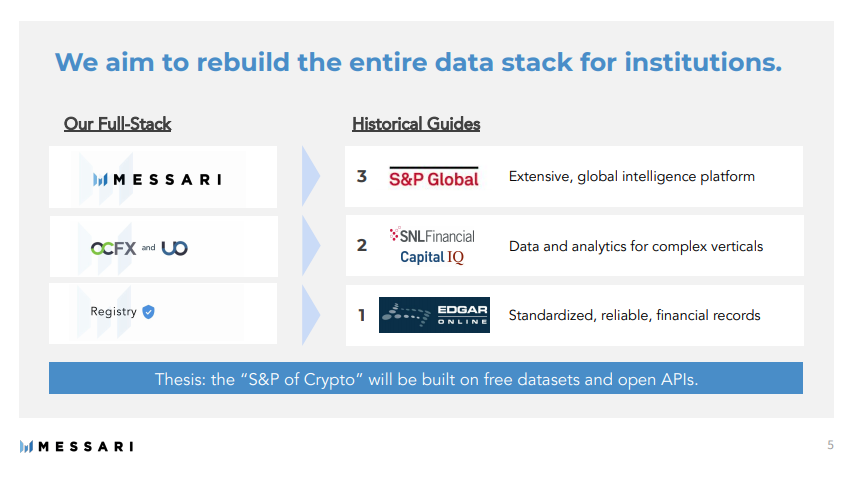

Slide #4

Goals: Show common sense medium term model; long-term vision

Before we can build the “Bloomberg of crypto” we need to build EDGAR.

Some people are getting way ahead of themselves. We are not.

This ecosystem will take a decade to take shape and fully thrive, and we have a game plan for bad markets (like now), and moon markets (where we are well-positioned if we get things right now).

EDGAR isn’t a sexy comp, until you realize that whoever builds that effectively will have created a global public utility whose standards sit outside of any SRO or government regulator. We aren’t necessarily at the mercy of the SEC, but we can be a terrific tool for them and their international brethren.

Slide #5

Goals: Show THIS TEAM SHIPS, and highlight the important pieces we’ve built

We’ve followed through on the vision we outlined to investors in late 2017.

This was an important one to us. We wanted to show that we were picking up steam on the product front, that our registry business was cruising, and that we had been a model of consistency in turbulent times: we were executing on the same vision we outlined at the market top and cycle low with very little variance.

Slide #6

Goals: Show how those pieces can come together for a bigger whole

We’re ready to take this company to the next level with a killer SaaS product.

The token economy fell wayyyyy out of favor, but we were ready to hit the market with a business intelligence product (as we’d outlined in late 2017) right on time. This raise wasn’t for a token-curated registry (although we still think there is promise in the concept), but for a highly intuitive picks and shovels software business that sat outside of the token ecosystem.

Slide #7

Goals: We’ve build serious IP on the back-end

This is our moat, we’ve built a data ingestion machine and robust API.

[redacted] come on guys, you don’t get to see everything.

Slide #8

Goals: We’ve got an unfair brand advantage right now, and broad reach.

How many data companies have brand affinity? We’re doing something good.

From day one, we invested heavily in building a community and solving a problem that was ultimately about crypto’s values. Were we building an ethical ecosystem that could say - with a straight face - we were making things better than the existing status quo?

We thought 2017 was a set back for crypto’s values.

Transparency, collaboration, proactive communication could fix things, and we worked to reinforce that thesis at a brand level. It generally worked.

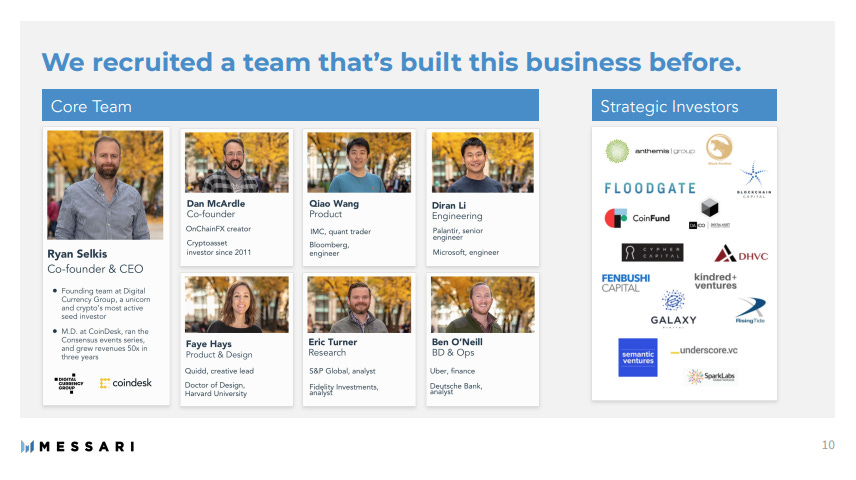

Slide #9

Goals: We’ve built a killer team.

We’re not just tinkerers. We're a team that loves crypto and has done this before.

This was also my opportunity to explain why we had so many investors at such a small initial valuation and round size: we “recruited” them as part of our extended global business development team without taking on risk of tying ourselves too closely with any single crypto fund and their affiliated investments.

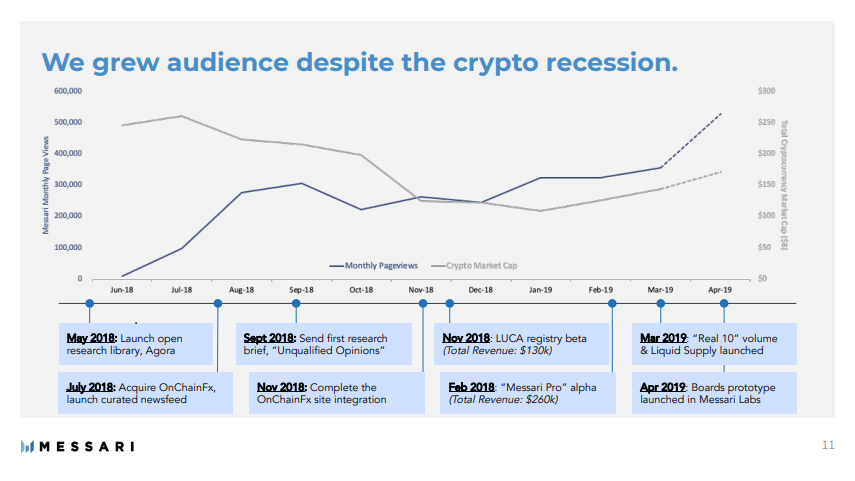

Slide #10-11

Goals: Show traction

This market sucks, but we’ve still been growing nicely.

Not much to add here. Other than the fact we felt we were one of the few companies that could pitch investors on real traction vs. vision. We felt we had the right vision as well, but the traction was keeping the lights on and preventing us from running out of money despite our low cash balance.

Slide #12 - path to scale

Goals: Show medium term viability of our model and hint at Series A milestones

We’ve delivered with a skeleton crew, here’s what happens with funding.

Not too aggressive, not too conservative. And these are numbers we feel like we could hit. (This slide was the only thing that got me really pissed off at the chicken shit leaker. Now this is floating in the ether, and we’ll have our feet held to the fire by VCs in 2021 re how we delivered versus this slide. C’est la vie. We can do it.)

Slide #13 - TAM

Goals: Show the bridge between the first "$10 trillion” slide, and current reality

Yes, the market is small, but we want to dominate small markets & ride the wave.

This is the set-up for the big finish, and also confronts the biggest question we were getting in “pre-meetings” head on. “Is this a market that could command a $100 million revenue business in the medium-term?” There was (and maybe still is) skepticism around this point. BUT

Slide #14 - Big finish

Goals: Show the path to a moonshot.

There’s an even bigger opportunity here in the moon case...

If you believe:

crypto will be as disruptive to finance as the internet was to information; AND

you believe that data is the most valuable commodity in the world / the data giants are the most valuable companies in the world…

Then:

it’s not farfetched to see most value in crypto accrue to the winning data providers in the long-term. exchange margins will get whittled away, and most marketplace rents will disappear in these decentralized networks. data still needs to power dapps.

Believable, if a bit fuzzy.

But so were the models around “search for anything”, “connect with your friends”, and “call a black car from your phone.”

Some of our investors wanted us to kill this slide because it was over the top.

I say “nah, we’re gonna keep it.”

So that’s that. What do you think?

-TBI

Messari Compression Algorithm

Content and thoughts from around the web as summarized by the Messari team.

🏛 On November 12, 2019, the SEC ordered a review of the disapproval by the Division of Trading and Markets’ (TM) of the NYSE Arca application to list shares of the Bitwise Bitcoin ETF Trust. The orders opens a 30 day comment period following publication in the Federal Register in which the Commission seeks input from the public on the disapproval order. Industry participants may submit comments here or by emailing rule-comments@sec.gov with SR-NYSEArca-2019-01 in the subject line.

Why it matters:

This review is unlikely to result in a reversal of TM’s disapproval action. Still, this review gives the industry the opportunity to provide direct comments to the Commission and Staff regarding the analysis – both by Bitwise and by TM – of bitcoin markets.

The Commission-level review was triggered under Rule 431, a little-used procedural maneuver through which a Commissioner may stay (temporarily halt) an action taken by a Division. Rule 431 was used at the request of CBOE BZX when TM disapproved the application to list Winklevoss Bitcoin Trust shares in 2017 and resulted in the more robust 2018 rejection. It appears, in this circumstance, however, that one or more Commissioners pulled the order for review without third party request. Rumor is it was Commissioner Hester. Interestingly, there’s no time limit for this sort of review. Stay tuned.

🌏 A group consisting of five emerging markets including Brazil, Russia, India, China, and South Africa, recently revealed a plan to create a unified payment system that settles transactions in a single cryptocurrency.

Kirill Dmitriev, CEO of the Russian Direct Investment Fund (RDIF), a $10 billion sovereign wealth fund by the Russian government who proposed the plan suggested that the BRICS cryptocurrency will not be a full-fledged settlement tool, rather “Most likely, it will be like certain obligations that can be transferred from one legal entity to another to confirm that the recipient will have claim rights, and the contractor will have obligations for a specific amount. It will not be money, we can say that it will be a paperless document flow to facilitate transactions.”

Why it matters:

BRICS consists of the most powerful emerging economies in the world. The group is explicitly attempting to reduce its reliance on the U.S. Dollar and United States financial system in facilitating international trade. The Economic Times reported yesterday that three of the BRICs members, China, Russia, and India, are also “exploring an alternative to the US-dominated SWIFT (Society for Worldwide Interbank Financial Telecommunication) payment mechanism in a bid to smoothen trade with countries facing American sanctions.”

Sovereign interest in cryptocurrencies has risen dramatically in 2019 since the announcement of Facebook’s Libra. In the past month alone there have been numerous announcements of government cryptocurrency projects. This latest revelation adds more fuel to what is shaping up to be a digital currency arms race as many nations are slowly recognizing the opportunity to re-architect the international monetary system using blockchain technology.

Send me the link, your twitter handle and your best imitation compression algorithm write up. If I like it, I’ll include your bit next issue (with attribution).

Should your colleagues read daily? We now offer discounts for corporate access. Email us, and we’ll onboard your whole team.