Messari's Weekend Reads 😎 - Unqualified Opinions

reading, sleep, and self-care (and not confusing staking rewards with interest)

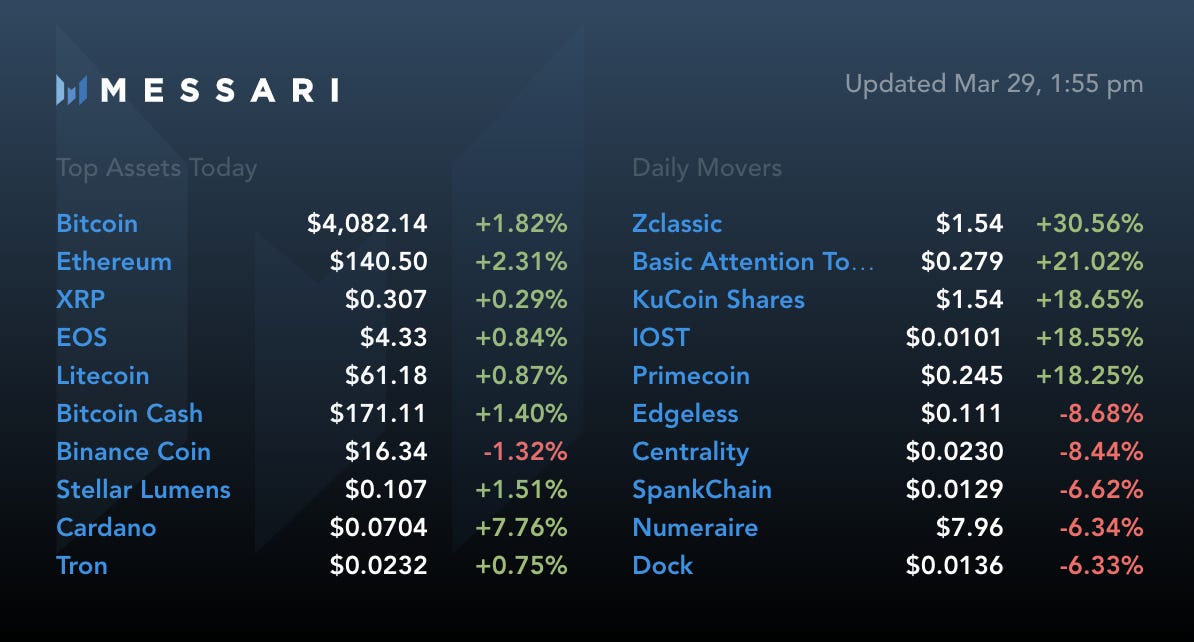

Your daily snapshot from our OnChainFX markets dashboard.

We covered a lot of ground this week in our mission to drive transparency and smarter decision making in crypto. Cleaning up trading volume data, market cap information, and uncovering a major inflation bug that affected a top 10 crypto asset.

It looks like we’ll have our hands full again next week correcting more misleading jargon. Namely, staking yields are not “interest.” Usually more like: “running in place.”

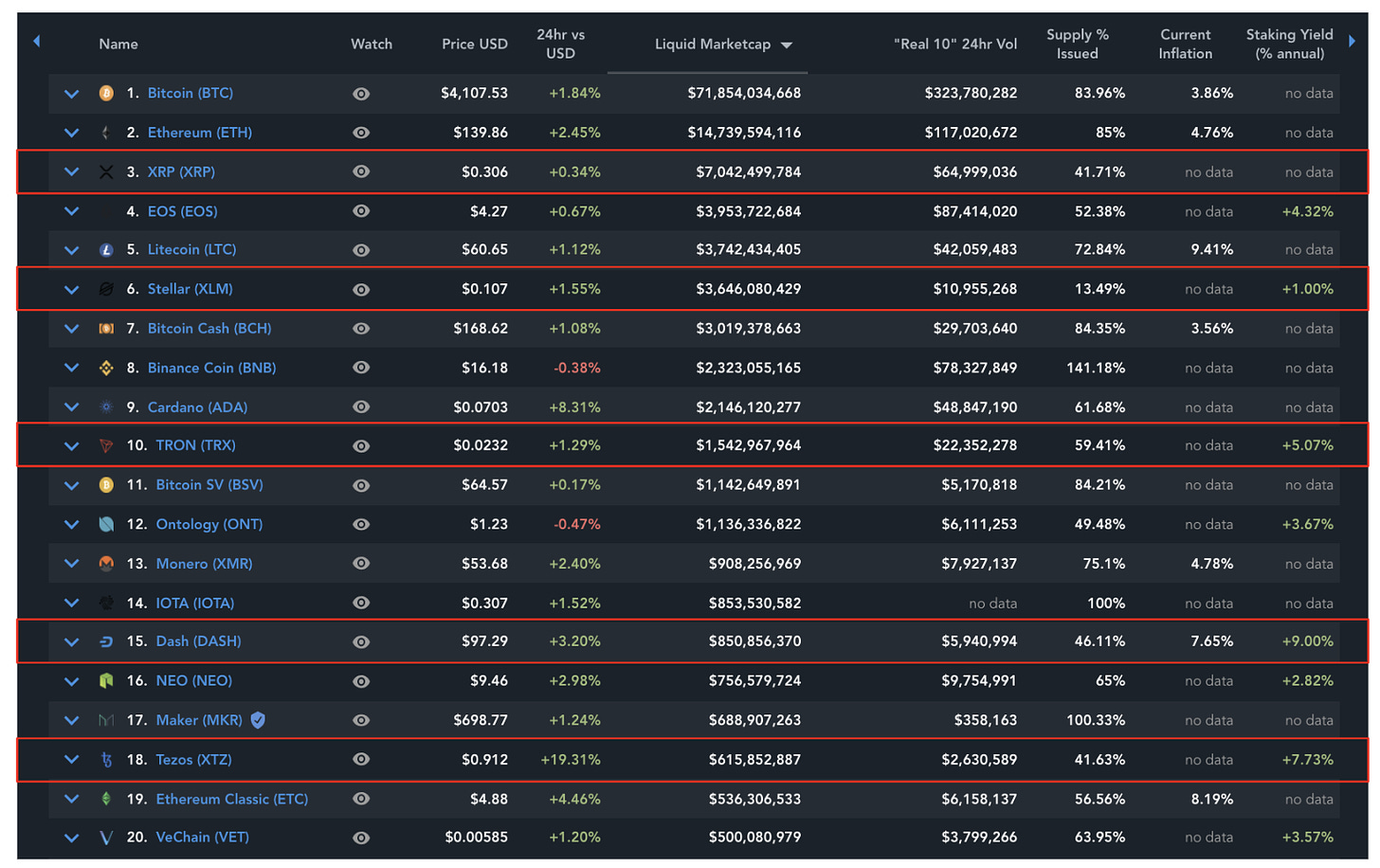

One of these columns below is about to get fully filled out next week. Want to venture a guess which one, and what we’ll be covering in our Tuesday research brief? :)

It’s gonna be another big month for the good guys in April. :)

Until then…

We’re keeping things light with some weekend reads and new data!

📚 Messari’s weekend reads:

Block Reward Halving and Venture Fund III Closing :: Pantera Blockchain Letter, March 2019 - Pantera Capital

Crypto Castle Was Once the Face of Bitcoin Mania. Now Things Are Different - Jeff Wilser

Is it time for a 21st-century version of 'The Day After'? - Marsha Gordon

Bitcoin is a hedge against the cashless society - Su Zhu and Hasu

The Time Value of Bitcoin - Nik Bhatia

The long, complicated, and extremely frustrating history of Medium, 2012–present - Laura Hazard Owen

Crypto funds: Don’t let accounting drive economics - XBTO

Real 10 Volume

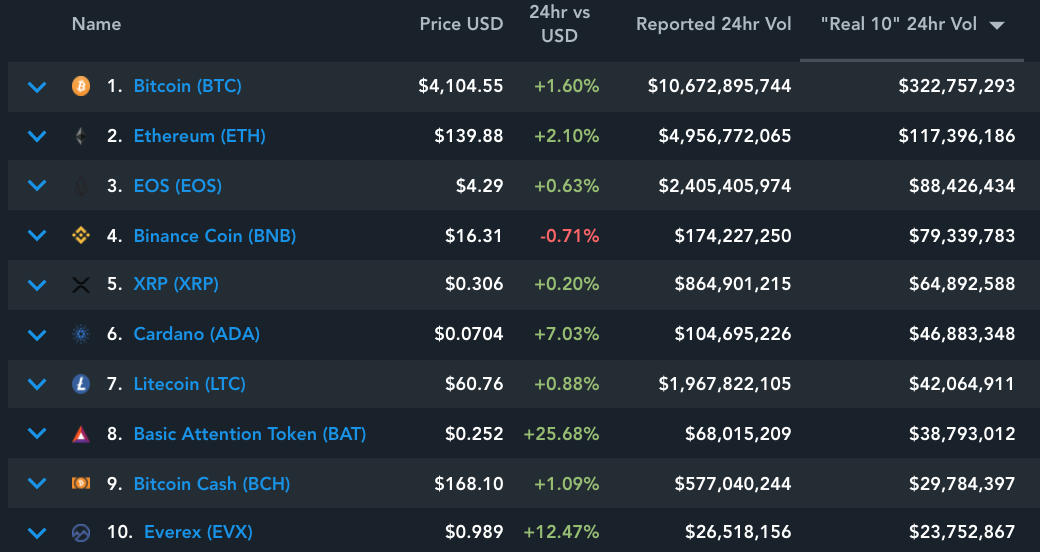

In case you missed it, earlier this week we rolled out “Real 10” volume and “Liquid Market Cap” on the OnChainFX dashboard.

Real 10 volume uses exchanges mentioned in the recent Bitwise Investments markets data research report to show legitimate trading volumes from global exchanges. There are of course other exchanges out there that have legitimate volumes, 10 was just a starting place. If you work for an exchange and would like to see your volume listed on Messari send us an email and we will get in touch.

Liquid Market Cap

Liquid Market Cap is the product of our asset prices (methodology here), and our research team’s “Liquid Supply” estimates for the Top 50 assets plus Messari token registry participants. Our team has spent countless hours building robust supply curves (h/t Florent Moulin) and measures like liquid market cap are the fruits of that labor.

See these new metrics and more on the OnChainFX dashboard now.

Have a good weekend, y’all.

- The Messari Team

P.S. Share. Subscribe. Tweet at Messari for feedback, comments, or questions.

Messari Compression Algorithm

Content and thoughts from around the web as summarized by the Messari team.

🔥 [Analysis] Why Mark Zuckerberg and Jack Dorsey are warming to blockchain - Michael Casey

As backlash against “surveillance capitalism” intensifies, user rebellion is forcing a design rethink at these companies, explains Michael Casey. Because of the underlying principles of blockchain technology, these companies are taking a serious look at integrating this technology. Facebook is experimenting with its highly hyped (and private) blockchain team. Twitter and Square’s Jack Dorsey seems to "have gotten religion" when it comes to Bitcoin and and the Lightning Network. Perhaps these corporations will adopt new business models in which users are no longer the product but the consumer. (share or read more)

🌎 [Analysis] The role digital currencies are playing in geopolitics - Andrew Gillick

Bitcoin ($BTC) and other digital currencies are supported by a strong desire for them to overtake (or at least severely compete with) sovereign monies. Brave New Coin's Andrew Gillick notes that cryptocurrencies are already playing a significant role in geopolitics as less-powerful nation-states realize their new ability to circumvent the political pressure routinely applied to them by world leaders who issue dominant reserve currencies. Experiments like Venezuela's El Petro are unlikely to experience lasting success, but as fiat reserve currencies inch closer to another crisis and countries like Russia and Iran prove Bitcoin's use case to evade international political pressure, other governments are likely to follow suit. (share or read more)

Quick Bits (Don't read that, I read it for you)

Choke Points (Exchange News)

🥩 Coinbase announced an expansion of its custody business to allow institutional clients tap into rewards offered by certain types of digital assets running on proof-of-stake networks via “staking” services (a.k.a., "staking as a service") starting with Tezos ($XTZ). (share or read more)

🔒 Ledger and Legacy Trust, a Hong Kong-licensed and public trust company, announced their partnership to launch institutional-grade custody solutions for OTC firms, exchanges, and high net-worth individuals. (share or read more)

Startup Signals (ICOs, Cryptos, and Startups)

🌳 The VeriBlock blockchain went live on Tuesday on the Bitcoin ($BTC) mainnet after a year on testnet, allowing exchanges, wallet providers, merchants and other crypto businesses to leverage Bitcoin’s robust blockchain security, Bitcoin Magazine reports. (share or read more)

🎮 The TRON Foundation has acquired the blockchain app store CoinPlay, according to CEO Justin Sun's Twitter. CoinPlay reportedly offers a variety of blockchain software and games, as well as practical guides, browser navigation, ratings, and indices of major currencies. (share or read more)

The Powers That Be (Legal/Reg/Policy)

🏦 Japanese prosecutors have reportedly dropped their appeal to the acquittal of former MtGox CEO Mark Karpeles. Karpeles was reportedly accused of taking 341 million yen ($3 million) of customers’ money in Mt. Gox accounts and spending it on a software developer and personal extravagances. (share or read more)

Did I miss something?

Send me the link, your twitter handle and your best imitation compression algorithm write up. If I like it, I’ll include your bit next issue (with attribution).

Should your colleagues read daily? We now offer discounts for corporate access. Email us, and we’ll onboard your whole team.