Your daily snapshot from our Messari screener.

🚨 New DeFi Features! 🚨

I am STOKED.

We've just added a variety of Defi metrics from Loanscan.io to the Messari site to help aspiring DeFi investors and analysts wrap their heads around the emerging permissionless lending market.

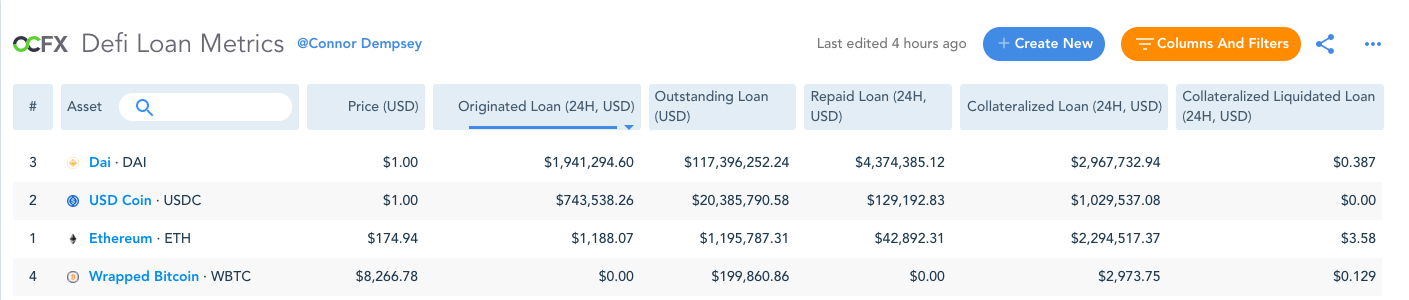

You can now track aggregate loan data from MakerDAO, DyDx and Compound Finance for ETH, USDC, DAI, and Wrapped BTC via the Messari screener, with more to come in the weeks and months ahead. This includes 24 hour USD volumes for total loans originated, loans outstanding, loans repaid and loans collateralized.

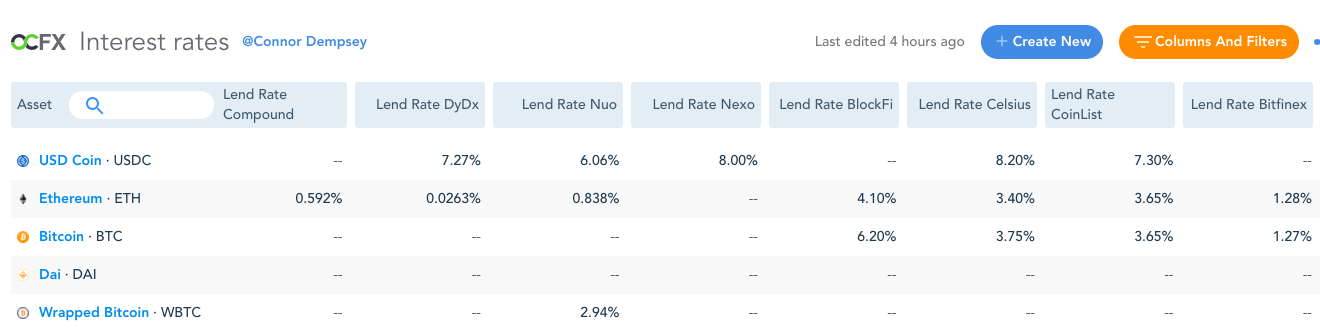

Additionally, you can now also track interest rates for Bitcoin, Ethereum, USDC, DAI and WBTC from centralized lending platforms like Blockfi, Celsius, Nuo, Nexo, CoinList, as well as from decentralized platforms, Compound and DyDx.

Even better!

You can combine these metrics with our advanced filtering and more than 100 other metrics with Messari Pro. (Get started now with a seven-day free trial.)

Enjoy, and see you tomorrow.

-TBI

Messari Compression Algorithm

Content and thoughts from around the web as summarized by the Messari team.

🔖 Fidelity Digital Assets has obtained a trust company charter courtesy of the New York Department of Financial Services (DFS) to engage in “virtual currency business activities” according to a press release. The regulatory approval provides the Fidelity Investments subsidiary the legal freedom to serve as a Bitcoin custody and execution platform for institutional investors. With the news, the company became the 23rd crypto-focused company to receive DFS approval for a charter or Bitlicense.

Why it matters:

Fidelity Investments is one of the premier incumbents that have a long-standing affiliation with Bitcoin. Reports suggest Fidelity started mining Bitcoin as early as 2014, and the team has a history of helping grow Bitcoin adoption among institutional investors.

The news coincided with the Galaxy Digital Holdings announcement that it selected Fidelity (alongside Intercontinental Exchange's Bakkt) to the Bitcoin holdings in its new funds.

🦊 Shapeshift announced that it would roll out zero commission trading in an effort to promote its non-custodial cryptocurrency exchange. Trading will be enabled by Shapeshift’s previously announced FOX loyalty token, which allows users to access zero commission trading by simply holding it. Upon creating a new Shapeshift account users will receive 100 FOX, which allows $1,000 of free trading volume on a rolling 30 day basis. Thus, each FOX token grants $10 of free trading volume every 30 days, in perpetuity.

Why it matters:

Self-sovereignty is a fundamental value to cryptocurrency. Cryptocurrency grants individuals the power to control their wealth through the use of cryptographic keys. However, to date most users have tended to sacrifice sovereignty for convenience, choosing to custody their crypto with trusted third parties like cryptocurrency exchanges. The roll-out of zero commission trading could be a boom to winning back sovereignty from cryptocurrency exchanges.

Non-custodial exchanges are not new. Self-custody is arguably the raison d'etre of the entire category of decentralized exchanges (DEXs). However, DEXs have failed to scale to date due to technical limitations, high fees, and speed. Shapeshift is likely now the cheapest, most scalable non-custodial exchange in the world.