Securities Law & Crypto - Unqualified Opinions #14

the rich get richer in the open financial system

TL;DR

Securities Law & Crypto - Unqualified Opinions #14

(7 minute read - a securities law primer)

ALL of the securities law fun

There’s been a ton of online discussion recently (mostly criticisms) of “accredited investor” rules in private fundraising, specifically as it pertains to investing in new crypto projects.

The common threads? It’s immoral to restrict adults from engaging in commerce on the grounds that they aren’t “qualified” to do their own homework. It further enriches the wealthy at the expense of the little guy. It’s difficult / expensive to police. Etc.

(We’ve even seen people bragging about how easy it is to forge docs on various KYC platforms to “get around” requirements...for the love of god, guys, don’t brag about that on twitter.)

This post isn’t about a self-righteous stance, but rather, a bit of nuanced context around how the private fundraising marketplaces actually work for the uninitiated. What are the actual requirements under accredited investor laws, and how could the crypto crowdfunding trend frame some of the rethinking around those requirements?

📚 Crash course in registered & unregistered securities offerings.

As a general matter, every single offer and sale of a security is required by US federal securities law to either be registered with the Securities & Exchange Commission (lengthy and expensive process); or claim some exemption from that registration.

A company or private fund may not offer or sell securities unless the transaction has been registered or an applicable exemption exists. More color on the two paths:

In order to properly “register" a security under the Securities Act of ‘33 (yep, 85 years old law, just one part of federal legislation the SEC enforces), a company would have to file an S-1 registration statement, or what’s commonly known as a “prospectus.” These include things like business description and risk factors of investing, planned use and distribution of proceeds, and a description of the securities themselves. The S-1 also includes audited financial statements. (Example of a S-1 form is here. They’re long, and expensive to file.)

Current federal securities law allows for companies or private funds to fundraise without having to register with the SEC, provided these companies or funds are eligible for an exemption to registration. These exemptions have existed for decades, but the 2012 JOBS act signed or amended a couple of new ones into existence: Regulation A (effective as of June 19, 2015), Regulation Crowdfunding (May 16, 2016), Regulation D 506 (c) (effective as of September 2013). These were mostly intended to make it easier for small businesses to raise funds from more investors. There are different requirements for each of the rules—limited fund size, accredited investor status, etc.

We’ll avoid going too deep into the dumpster fire of securities law, but here’s the main thing to know: the trend we’re seeing in fundraising is away from IPOs and towards unregistered, exempt offerings. The U.S. has seen a steady and significant decrease in the number of public reporting companies in the U.S., particularly since the dot com crash and subsequent implementation of the Sarbanes‐Oxley Act.

Since the financial crisis, IPO activity is flat, while private offerings have doubled.

Source: sec.gov

The decline in public offerings makes sense.

The IPO registration process is a long and difficult process for most companies. The paperwork plus legal/ audit/ accounting fees, and the constant filings requirements turn off smaller companies.

If you issue or sell your securities under something like Rule 506, on the other hand, you have less ongoing reporting to worry about, AND those are considered “covered securities” that are exempt from state securities law registration and qualification requirements. It’s much easier for a company to raise money through private means vs. an IPO these days.

Since the JOBS act, we have seen a number of companies de-registering (relying instead on private or example offerings to raise capital), and choosing to defer their IPOs (relying instead on private financing). High profile examples of pre-IPO private placements include the likes of Pinterest, Uber, Spotify, Palantir, etc. all $10 billion+ companies that historically would have been prime IPO candidates.

That’s all led to a private market that in 2017, saw $ 3.0 trillion USD flow into private offerings in the U.S.

🕵🏻 So what is an “accredited investor”, and why are people worked up about it?

In order to qualified as an accredited investor, you gotta have money. Either…

a net worth of at least $1 million (excluding value of primary residence), OR

earned income that exceeds $200,000 in each of the prior two years— and can expect the same for the current year (or, together with a spouse, $300,000)

Still, for all the uproar over accredited investor-only fundraises, it’s really only Rule 506 (c) which restricts investment access to non-accredited investors.

Given that there are a number of other exemptions a private company could rely on, what’s the big deal?

I’M GLAD YOU ASKED.

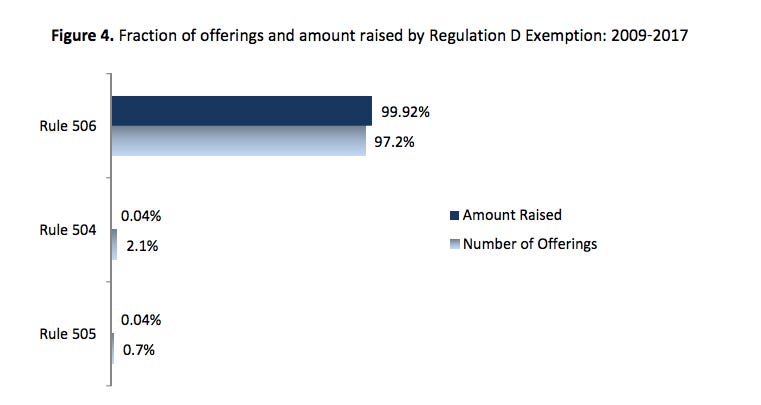

Rule 506 (c) sits under Reg D, which accounted for $1.8 trillion dollars raised in 2017 - about 60% of the total private funding.

To put this into perspective, the amount of money raised via Reg D, Rule 506 is considerably larger than the amount of public debt (straight and convertible debt) AND public equity (common and preferred) offerings over the same time period.

In fact, almost all Reg D exemptions tie back to Rule 506, which is pretty much the only rule that is inflexible when it comes to non-accredited investor participation.

Source: sec.gov

Frustrating.

[TBI Note: Open access, and ridiculous, meritocratically-distributed gains are without question part of the religious allegiance many have to bitcoin and ether. It’s more than frustrating. It’s bullshit.]

Why should how much money you have dictate what you are, or are not, allowed to invest in? The $200,000 income number seems super random, and the $1 million net worth hurdle seems laughably out of touch to the majority of the population. Plus, money and knowledge don’t always go hand in hand.

🤷🏻 Protecting investors: some practical observations...

Some private crypto investors have mocked how “easy” the verification process for accredited investors is on the various platforms that offer KYC services. Yet while it is true you can easily manipulate screenshots or images in order to circumvent investing requirements, this misses the point of the accredited investor laws.

Accredited investor standards are meant to protect the *investors*, not the issuer.

The burden and responsibility of the status verification process falls on the shoulder of the issuers of the securities. The issuer has a responsibility to demonstrate they did their reasonable, best efforts due diligence (there are different thresholds for this depending on the exemption you rely on).

If they do that, and an investor lies to them, that’s not on the issuer. Still, misrepresenting your own investor status means it's most likely the company/issuer that gets screwed because it could jeopardize their ability to rely on something like, 506 (b) or (c) to fundraise.

Unlike scoring an ID from an older sibling when you’re still under 21, it’s not something to really brag about.

[TBI Note: Not that anyone on our team has ever done that.]

🧠My brain is melting.

Almost done.

A lot of token sales— especially this year— have taken the route of a Reg D offerings in order to comply with existing securities law.

It’s a good thing that more issuers are being cautious / thoughtful with the way they raise funds, but it also seems somewhat antithetical to crypto’s entire ethos, which is to build towards an open financial system, and level the playing field for everyone regardless of income or wealth.

Raising money under Reg D is the path of least resistance, though. Companies don’t really need to disclose any information about themselves publicly aside from a four page form, something that’s more appealing given the rising intensity of crypto competition. Moreover, the entire SEC exists pretty much to protect investors, so it’s a bad risk-reward tradeoff to take shortcuts when selling volatile, unproven assets.

There have been some ideas in D.C. floated that would attempt to solve existing accredited investor issues. This summer, a bill was introduced in D.C. that proposed to consider someone’s “qualifying education and experience” to determine status.

Common sense, but still problematic. Who’s to determine what constitutes "qualifying education”? How will that be tested and standardized?

[TBI Note: Let’s give the SEC Jim Crow investor law power. What could go wrong there?]

🤓 I’m done, I promise…

Token sales have introduced a new form of fundraising—or more specifically, a new form of crowdfunding. But due to the legal and regulatory considerations, token teams are falling back on the traditional private fundraising model—an outdated and arbitrary one that shuts out valuable potential network participants, but a devil that’s at least well known.

I’ve barely scratched the surface, but I’ll stop to give you a breather.

I’m not barred in any U.S. state and this is most definitely not legal advice (hire your own counsel, fam), but I do hope these ramblings from a huge legal and policy nerd shed more light on a much discussed, but little understood process.

As always, if you’ve made it this far in my ramblings…you are the MVP.

P.S. Tweet at me or Messari for feedback, comments, questions, and the like. Then subscribe and share if you haven't already :)

[TBI Note: There are good people in the SEC. They are mostly well intentioned public servants, and they actually share our mission at Messari: protect investors, promote responsible capital formation, and keep the markets fair and efficient. The problem is that securities laws suck and are horribly outdated, the staff is overmatched, and the commission never actually penalizes the truly evil, just the truly easy to catch. Aside from the ineptitude of the SEC in adequately fulfilling its basic mission - at great national expense - it’s pretty great.]

News & Analyses

Quick Bits (Don't read that, I read it for you)

Choke Points (Exchange News)

🙁 QuadrigaCX, Canada’s largest cryptocurrency exchange blamed a legal action by a major bank for delays some customers are experiencing while cashing out funds. The Canadian Imperial Bank of Commerce froze multiple accounts with approximately $22 million belonging to QuadrigaCS's payment processor and its owner in January this year. (Messari | Source)

🇯🇵 The chief policy officer of Coinbase, Mike Lempres, said he’s confident the crypto exchange will receive an operating license in Japan in 2019. Coinbase appointed former Morgan Stanley vet Nao Kitazawa to head its local office in June. (Messari | Source)

Swiss-based bank and brokerage Dukascopy announced it is launching ether trading. (Messari | Source)

Startup Signals (ICOs, Cryptos, and Startups)

🔻 ICO activity down 90% since start of 2018, a study by financial research firm Autonomous Research found. Fewer than $300 million was invested in ICO projects in September, a meager fraction of the approximately $3 billion that was raised by token sales at the beginning of the year. (Messari | Source)

🤑 The endowments of Harvard University, Stanford University, Dartmouth College, Massachusetts Institute of Technology, and the University of North Carolina have all made investments into at least one cryptocurrency fund, signifying growing acceptance of crypto assets among institutional investors. (Messari | Source)

📈 90 crypto hedge funds launched in the first three quarters of the year and that number is expected to reach 120 for the financial year, according to a report from Crypto Fund Research. (Messari | Source)

The Powers That Be (Legal/Reg/Policy)

🏦 The Monetary Authority of Singapore (MAS), the country’s central bank, is working to ensure crypto startups receive domestic banking services as part of the country's efforts to boost fintech development. However, the central bank currently has no intention to employ a licensing scheme for crypto exchanges. (Messari | Source)

🚨 Over the last few months, the Securities and Exchange Commission (SEC) has been cracking down on ICOs that didn't ensure tokens were sold exclusively to accredited investors, a qualification that allows U.S. startups to be exempted from having to register its securities offerings with the SEC. (Messari | Source)

"Celebrities" (Crypto Influencers)

💱 Bitcoin Cash advocate Roger Ver revealed plans to buy or develop his own exchange. He plans on tapping into the traffic from Bitcoin.com and using Bitcoin Cash as the base currency for the exchange. (Messari | Source)

Did I miss something?

Send me the link, your twitter handle and your best imitation compression algorithm write up. If I like it, I’ll include your bit next issue (with attribution).

Community Updates

Podcast Recap

We host & produce our own podcast on Spotify, iTunes, Soundcloud, and Google Play. Last week, Katherine was on the ground at Crypto Springs where she interviewed a bunch of speakers and attendees about their experience at the invite-only conference.

Apple Podcasts: here. Spotify: here. Soundcloud: here. Google play: here. Enjoy!

Shameless Plugs

We're Hiring:

We’ve got five engineering reqs up on our careers page. Join our fast growing team in NYC; work with crypto OGs, and former Bloomberg/Palantir engineers; and access a network that sets you up for the rest of your career. Apply here!

️Upcoming Travel:

Hit us up while we’re at:

SFBW, San Francisco, October 8-12th

Money 20/20, Las Vegas, October 21-24th

DevCon, Prague, Czech Republic October 30–November 2, 2018

Join Our Community!

If you are interested in helping us crowdsource token project details, or want to join our community to share your expertise, wed love to have you on board! Take a second to fill out an application and we will get back to you soon. Going forward, we’ll be capping new members at 15 each week to keep things running smoothly. If you haven’t heard back, you are probably in the queue.

Like what you read? Share it! Hate what you read? Let me know @MessariCrypto.