Structural US Bankruptcy

how it feels watching another changing of the crypto guard

Structural US Bankruptcy

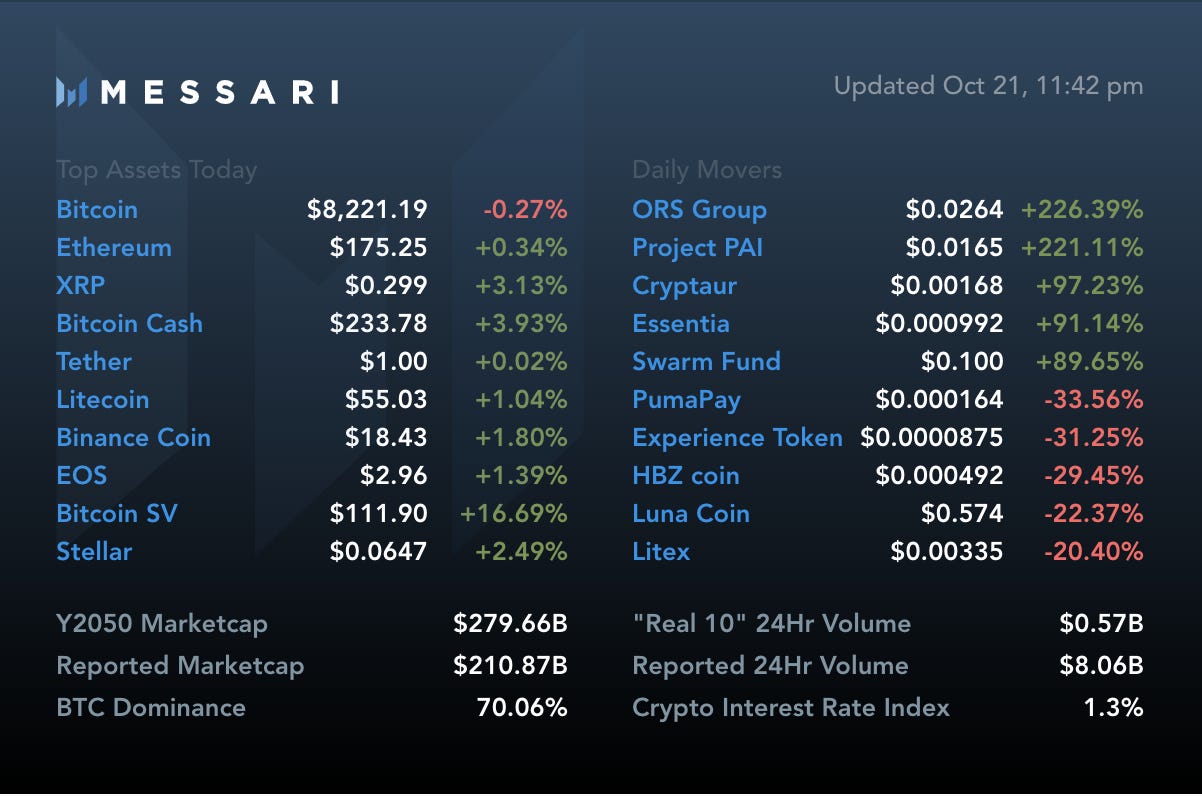

Crypto prices have recovered from their nadir twelve months ago, but we’re still looking at something we last saw in 2015: structural bankruptcy.

I mean that both literally and figuratively.

Circle's is the Least Bad Outcome?

In the literal sense, Circle seems to be seriously low on money, and looking for salvage value as it spins out its $400 million acquisition (Poloniex), winds down its formerly life-sustaining OTC trading operations (if not wound down fully, then nearly gone), and admits defeat in the US markets with respect to its bona fide crypto products.

If that sounds like a whopper of a fall from grace, it is.

But it’s hard to look at the current state of regulatory affairs and think Circle did anything other than crash the plane Captain Sully style, with a bit of embarrassment to the airline, but passengers ultimately...not dead?

They’ve got the SeedInvest business, an equity-but-probably-soon-to-be-securities-tokens-and-other-crypto-ey-things crowdfunding platform.

Plus they’ve got the $USDC business with currently half a billion under management (nearly 2x its closest comp in Paxos - check out our Stablecoin Index), which looks like the most credible regulated price stable cryptocurrency that will be on the market any time soon. I’m also cautiously optimistic for the API infrastructure they build around that. (Until Binance does something similar, I guess.)

Looking elsewhere around the non-Coinbase, non-Kraken American exchanges is bleaker. Like opening montage from Saving Private Ryan bleak. Circle is somehow the best positioned of the other second-tier US exchange operators post-Polo spinoff.

Bittrex has struggled ever since it’s public spat with the NYDFS and chaotic exit from the New York markets. Their volumes are about even with Polo’s, but without the side hustles to bail them out.

Same goes for Paxos’ itBit, whose volumes have shrunk to $4mm, about 25% of Polo & Bittrex’s. They have that Paxos Gold thing that just launched, but it seems small.

Gemini is still way down from a volumes standpoint as well, but we all know the Winklevoss twins will live forever - if only to wait out the SEC’s ETF approval process - so they don’t count.

Insult to injury

Unlike 2015, this structural US crypto recession isn’t due to apathy so much as it is to bloodletting that is primarily at the hands the US regulators and people still slowly coming to their senses about the “value” of most ICOs.

(But it is kinda. A little.)

It’s not entirely the exchange operators’ faults.

Circle bought Polo with the pitch it would bring the company into the regulatory light of compliance, only to slowly decay in the face of years-long delays from the SEC. Bittrex was a great platform even if it ultimately got leapfrogged by Binance. The trading and regulatory markets moved against them both.

But to be fair, there’s a bit of a sense that maybe some of these guys knew better?

Not sure if it’s the low water mark or the first of several sales, but the Polo exit throws into sharp contrast just how mean this extended token hangover has been. I don’t know, it seems as if it were somewhat expected after the pathological normalization of pump and dump token deals that even the adults got too drunk off of in 2017.

I’m not saying the SEC is functional, or that navigating the byzantine US environment is anything short of maddening, but when you peddle shit wholesale, and you’re an adult, you should know there’s a risk you’ll get messy and end up with weird results.

Nothing could prepare you for the weirdness we’ve seen though. The insults keep coming with the injuries.

And they cut DEEP.

Watching Circle bleed out publicly after trying to bring better compliance to Polo and eventually sell to Justin Sun (!!!) certainly seems like the adult equivalent of puking in an alley whilst trying (unsuccessfully) to locate your pants after a bad bender. They certainly went out of their way to not mention his involvement in the announcement.

And if you told me that Brad Garlinghouse would own MoneyGram and sell a billion dollars in XRP and fund a bunch of startups with their dirty money with Ben Lawsky on his board (!!!), while the former global #1 alt-exchange Bittrex slowly faded to black from the U.S. I mean, AGHHH. The indignity.

We do have to work harder keeping straight stoic faces, I suppose.

When we talk about banksters, and the men at the nanny state bailing out Wall Street, and us saving the other six billion, we’ve got to grin that forced 2015 smile.

Because we’re kinda sorta getting bailed out by the most ethically bankrupt of a rotten barrel of apples.

“And no one went to jail.”

Selling out to Justin Sun sure feels close enough, though.

-TBI

P.S. Justin Sun, won’t you come, and wash away the pain? Seriously, try ever listening to that song again without thinking of this man.

Quick Bits (don't read that, I read it for you)

💰Bigger in Texas: Bitmain has built a mining facility in Rockdale, Texas. The Chinese mining giant has developed 25MW of capacity, with 50MW remaining under construction, and aspirations to expand to 300MW in the future. This announcement comes days after mining firm Layer1 announced it raised $30 million of a $50 million Series A to run wind-powered Bitcoin mining facilities. Peter Thiel and Shasta Ventures, among other undisclosed cryptocurrency-focused investors, contributed to that round at a valuation of $200 million. We’re de-risking a bit geopolitically.

✅ Grayscale Investments had a big week when they announced they had raised $250mm in Q3 (that’s ~$5mm in very sticky ARR assuming a flat bitcoin price). They also received approval from the Financial Institution Regulatory Authority to offer a publicly-traded large-cap cryptoasset fund. As of 9/30/2019, the fund was comprised of 80.3% bitcoin ($BTC), 9.9% ethereum ($ETH), 5.8% XRP ($XRP), 2.2% bitcoin cash ($BTC) and 1.8% litecoin ($LTC).

🥇A new gold-backed token named DGLD has been launched by CoinShares, Blockchain, and swiss gold trading firm MKS. Tokens will initially trade on Blockchain's recently launched exchange The Pit and represent 1/10th of a troy ounce of gold. Underpinning the token is London based CommerceBlock's Mainstay protocol which records transactions on the Bitcoin ($BTC) blockchain.

🐦A new portfolio based on twitter sentiment went live on eToro earlier last week. TheTIE-LongOnly CopyPortfolio, powered by crypto data provider The TIE uses twitter analytics to create a portfolio based on the sentiment of tweets. At launch, the portfolio had a $2,000 minimum investment and will rebalance monthly based on the underlying algorithm.

Did I miss something?

Send me the link, your twitter handle and your best imitation compression algorithm write up. If I like it, I’ll include your bit next issue (with attribution).

Should your colleagues read daily? We now offer discounts for corporate access. Email us, and we’ll onboard your whole team.