(Your *customizable* daily markets dashboard courtesy of OnChainFx.)

This detailed report was sent via a separate email to Messari paid subscribers only. Their subscriptions pay for our research team’s hard work. If you are interested in accessing the full report, please subscribe, or contact us for corporate subscription rates by replying directly to this email. Below is a summary of that report’s findings.

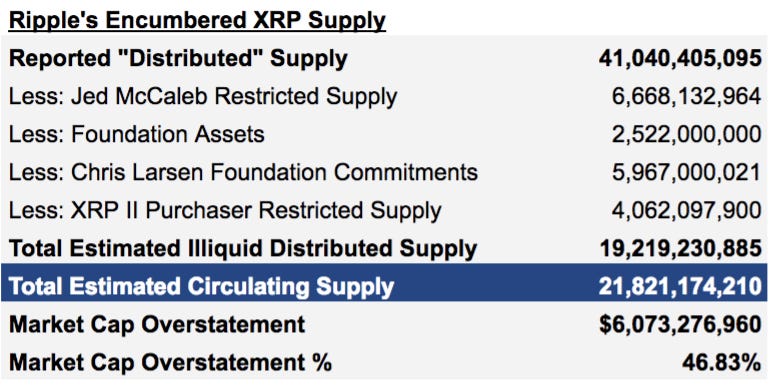

Ripple’s Market Cap Is Likely Overstated by $6.1 Billion

If history is a guide, Ripple is due to disclose its Q4 2018 transparency report as early as today. In advance of that report, we conducted extensive research into the health and legitimacy of the currently quoted XRP "market cap” available on third party crypto data services and exchanges. We believe the figure is significantly overstated; potentially by as much as $6.1 billion.

We have reached out multiple times to Ripple representatives for comment, but have not yet received a response to our inquiries. We acknowledge that some of the estimates in this report lack precision, but believe they are directionally correct, and presented in good faith. We look forward to Ripple’s response, and will update this report accordingly if and when they do reply.

Summary:

+ XRP’s liquid “circulating supply” and “market cap” could be overstated by 46%, which would put total XRP “market cap” at $6.9 billion vs. $13.0 billion widely reported at current USD-XRP exchange rate.

+ We recommend major indices, including Bloomberg-Galaxy, MVIS CryptoCompare, and the Bitwise 10 Large Cap Crypto Index, and others, as well as passive funds such as Grayscale’s Digital Large Cap, and Bitwise’s 10 Private Index Fund, review this report and reach out to us with questions regarding our methodology. (Our API documentation is available for review.) Pursuant to this report's finding that the true liquid market cap of XRP is significantly lower than previously reported, index weightings of XRP should likely be reduced. We do not believe reliance on Ripple’s XRP data API can be expected to yield accurate circulating supply figures in light of these findings. However, a more precise estimate of XRP supply will likely require proactive disclosures from Ripple, given the contractual restrictions the company has placed on a large percentage of its XRP resales.

+ In addition to the 59 billion XRP owned by Ripple and held on the company’s balance sheet (52.5 billion in long-term escrow, and 6.5 billion illiquid, but available for restricted sales), there could be significant, persistent sell-side pressure in the XRP market depending on the length and structure of selling restrictions placed on Ripple’s market making partners, a Ripple affiliated foundation, and Ripple’s co-founders, all of which appear to have negotiated rate limits for sales based on exchange trading volume of XRP.

+ Ripple has not shared the methodology or reference exchange data it uses to calculate trading volume for XRP, a critical data point that drives selling restrictions. More than 99% of XRP trading volume appears to come from overseas exchanges, many of which have been suspected of wash trading. We urge Ripple to disclose its volume-based selling methodology, as well as the amount of XRP subject to contractual volume-based selling limitations over time. This is necessary in order to help investors better understand the inflation and selling pressure in one of the industry’s largest assets, and is necessary to protect consumers and promote fair and efficient crypto markets.

+ A snapshot comparison of our circulating supply estimates vs. Ripple’s highlight the drastic difference between our deep dive and the company’s proposed statistics:

Methodology:

+ Today, Ripple’s selling restrictions on co-founder Jed McCaleb have locked up at least 6.7 billion of current XRP supply that can only be sold at a theoretical rate of 1% of daily trading volume. Jed told us: "What I can sell a day is significantly less than 1% of the total daily volume. I'm not sure I'm at liberty to say how [reference trading volume] is calculated.” Ripple co-founders Arthur Britto and Chris Larsen could have similar selling restrictions on their multi-billion dollar XRP allocations. However, we do not include those unknown amounts in our analysis, with the following exception...

+ We believe current circulating supply estimates include an illiquid position of 5.9 billion XRP, which has been publicly committed, but not yet donated, by co-founder Chris Larsen to RippleWorks, an affiliated California foundation, and registered 501(c)3 non-profit. Ripple previously communicated the existence of this donation on a (now deleted) post from the company’s CMO on the “RippleForum." This was in August 2014; the same time it announced the existence of Jed McCaleb’s original XRP liquidation agreement.

+ We reviewed public tax records for RippleWorks as well as XRP wallet addresses, which shows the foundation held at least 2.8 billion XRP as of April 30, 2017, and currently holds 2.5 billion XRP. These holdings contain daily selling restrictions "based on a percentage of the previous 24 hours total trading volume on designated exchanges.” We do not assume additional contributions from either Ripple or Chris Larsen to the Foundation in 2017 and 2018, as these could not be estimated from wallet address analysis, and is not yet publicly reported in RippleWorks Form 990 for the year ended April 30, 2018. We have reached out multiple times to Foundation representatives as to its 2017-2018 activity, but have not received any comment. We will update our analysis if and when we do.

+ Finally, we estimate that 4.1 billion XRP sold via the company’s money services business, XRP II since 2016, may be subject to re-selling restrictions (per the company’s own transparency reports). It is impossible to track the magnitude of this illiquidity without direct disclosures from Ripple, so we use a reasonable estimate.

+ Combined, this means 19.2 billion of the 41.0 billion XRP currently quotes as “in circulation” may be illiquid or subject to significant selling restrictions. In reality, this estimate may prove to be conservative, as they belie XRP trading volumes which have consistently fallen well below that of EOS and Litecoin, two cryptoassets whose current referenced market caps are a mere 17% and 15% of XRP’s, respectively. In addition, we believe the actual amount of “restricted” XRP in distributions to investors, banking partners, and team member may be significantly higher than our initial estimates reflect.

We reached out to Ripple and RippleWorks representatives for comment, and will update our research assumptions once we have received a response.

*The full 10 page research report and background details are available only for subscribers to Messari’s Unqualified Opinions research newsletter. Their support funds our ongoing efforts to bring better transparency to crypto.*

P.S. Spread the love. Tweet at Messari for requests, feedback, comments, or questions.

Messari Compression Algorithm

Content and thoughts from around the web as summarized by the Messari team.

📈 [Analysis] Data shows Bitcoin’s price volatility has been declining over its 10 year history - Kyle Torpey

The history of Bitcoin is the story of decreasing volatility. While crazy price movements such as November's 43.5% drop in 11 days are often cited, Bitcoin typically moves in tighter ranges than many other asset classes, including gold at times. Even more so, the moments of greatest volatility are becoming mundane compared to the past. For example, 2017's peak price crash stood at only 7.71%, before tumbling further, compared to 2013's 12.57% dive. As Bitcoin has transitioned from a cryptocurrency to a digital asset, it has become a less volatile store of value. (share or read more)

🕵️ [Analysis] The mystery of the Bitcoin nonce pattern - BitMEX Research

On Jan. 4, 2019, Twitter user @100trillionUSD posted a graph of nonce patterns spanning Bitcoin's history. It showed patterns in what should be a chaotic system since about block 40,000. Four horizontal patterns are easily discernible across equidistant nonce values. Nonce's are part of the block header and introduce entropy to drive the difficulty of Proof-of-Work (PoW) mining. TokenAnalyst and BitMEX research overlaid Bitcoin's nonce distribution with color assortments of active mining pools, discovering Antpool correlates more highly than other pools such as Bitfury or Slushpool with the patterns. Further analyses showed block 40,000 aligns with the speculated arrival of covert AsicBoost. However, these correlations lack substantiation, leaving the trail cold for now. (share or read more)

Quick Bits (Don't read that, I read it for you)

Choke Points (Exchange News)

🏛 According to a filing with the U.S. Securities and Exchange Commission (SEC) Cboe BZX Exchange, Inc. withdrew its application for a rule change that would have cleared the way for the VanEck SolidX Bitcoin Trust. The SEC was due to make a decision by the end of Feb. though it was noted by Jake Chervinsky that the government shutdown could impact this. (share or read more)

📇 South Korean crypto exchange Bithumb, one of the world's largest exchanges by trade volume, is seeking a backdoor entrance to listing in the U.S. according to documents from the SEC. In a reverse merger, Bithumb will become a subsidiary of Blockchain Industries, which will rename to Blockchain Exchange Alliance. (share or read more)

Startup Signals (ICOs, Cryptos, and Startups)

📱 Leaked images online confirm the pressing arrival of Samsung's Blockchain KeyStore app. Images show wallet options for importing an existing wallet or setting one up. The wallet is claimed to host Bitcoin, Ethereum, ERC20 tokens, and Bitcoin Cash. (share or read more)

🤩 Diogo Mónica and Nathan McCauley formerly of Square and Docker announced digital asset custodian Anchorage, which raised $17 million in a series A fundraising round from the likes of Andreessen Horowitz and Papal co-founder Max Levchin's SciFi VC. (share or read more)

The Powers That Be (Legal/Reg/Policy)

💸 New Hampshire is looking to join Ohio as the first two states to accept cryptocurrencies as settlement for taxes and other fees. House Bill 470 was introduced by Representatives Dennis Acton and Michael Yakubovich on Jan. 3rd and had its first hearing yesterday, Jan. 23rd. (share or read more)

💣 The UK's Financial Conduct Authority has released a consultation paper on utility tokens, rejecting the SEC's decentralization test as criteria to be a security token. According to Twitter analyses from Blockchain's President and CLO Marco Santori, the FCA does not hold jurisdiction over utility tokens because they do not fit the requirements to be called security tokens. (share or read more)

Did I miss something?

Send me the link, your twitter handle and your best imitation compression algorithm write up. If I like it, I’ll include your bit next issue (with attribution).

Podcast Recap

🎧 ICYMI last week Ryan (TBI) and Arjun Balaji sat down for over an hour to discuss what they see happening in the industry during 2019. If you are a subscriber, make sure you have caught up on our two part series and check out Arjun’s theses for 2019.

You can view the full video here and as always you can listen and subscribe to all of our podcasts— on Apple Podcasts here, Spotify here, and Google play here.

Shameless Plugs

We want your feedback!

We know Messari can feel like a couple different products right now, and we're working to unify our features into one overarching whole. Head over to our new feedback tool and let us know what you think!

🛠We're Hiring:

We need data engineers who want to bring transparency to crypto!

Join a fast growing team in NYC; work with crypto OGs, and former Bloomberg/Palantir engineers; & access a network that sets you up for the rest of your career. Apply here!

Join Our Community:

If you are interested in helping us crowdsource token project details, or want to join our community to share your expertise, we’d love to have you on board! Take a second to fill out an application and we will get back to you soon.

Going forward, we’ll be capping new members at 15 each week to keep things running smoothly. If you haven’t heard back, you are probably in the queue.

Like what you read? Share it! Hate what you read? Let me know @MessariCrypto.