Thoughts on Token Supply - Unqualified Opinions

liquid supply is just a formula, and we can isolate the variables

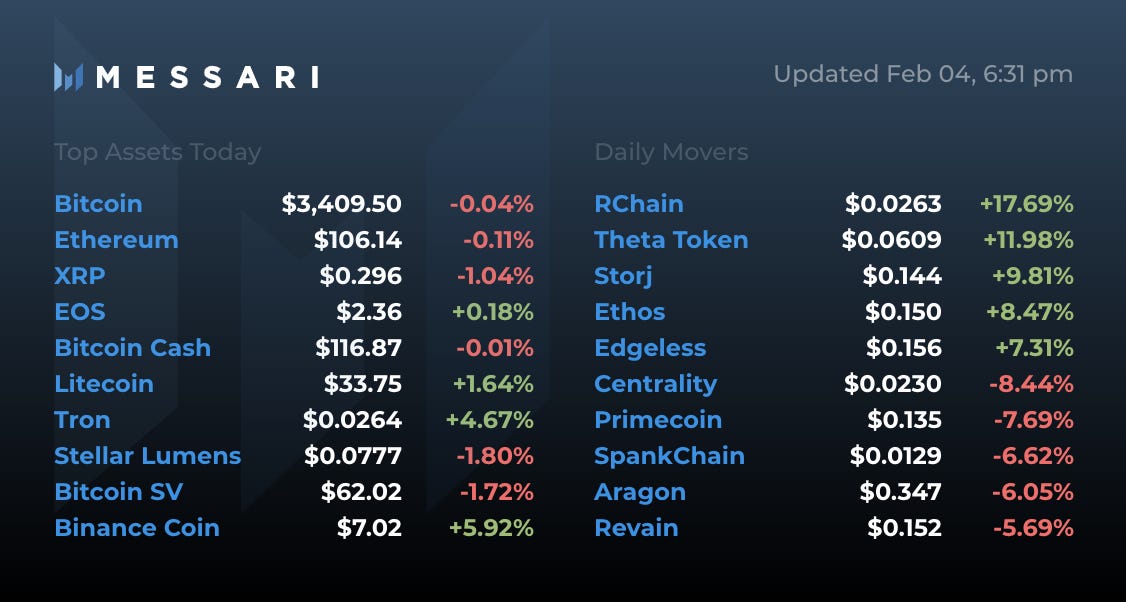

Your real-time markets snapshot courtesy of OnChainFx

Thoughts on Token Supply

There are only a couple of hills I’m willing to die on in this industry. The need to fix crypto investors' misuse of the term “market cap” is one of them.

For illustration of the scope and perniciousness of the problem, take this explanation from Forbes CryptoMarkets re how they calculate circulating supply:

"Traditionally as a financial term, market capitalization is total supply multiplied by the price. Market capitalization measures what a company is worth as valued by the free and open market, which encapsulates the market's perception of its future prospects, because it reflects what investors are willing to pay for each “unit” whether it be a share, token, or currency.

Circulation supply in crypto is typically roughly defined as the “float” in the traditional financial classification. The "float" is the number of outstanding units for trading by the general public. The free-float method of calculating market cap excludes locked-up shares, such as those held by company executives, restricted investors, governments or other entities that have clear, defined restrictions on the units preventing them from being arbitrarily released or sold.

To restrict sale or trading of units, there must be clear guidelines & legal clarifications. The units cannot be arbitrarily declared “restricted.” The units could just as easily be determined “unrestricted” immediately thereafter. In order to be removed from the circulating supply or float calculations, one needs to know how long and under what circumstances do they have the opportunity to enter the float.

Now, this brings us to how FCM is currently classifying XRP, and the reasons behind it: On the XRP website, and in the XRP API, three segments of XRP's supply are disclosed: escrow, undistributed and distributed. All three segments of their supply fluctuate periodically. None of these supply categories are genuinely frozen. There is no clear rules or guidelines as to what, if any, of these buckets are truly or legally restricted.

Consequently, based on this, FCM is concluding (for now) that any of these buckets can be available for sale to enter free float at any given time. We are not making any speculative guesses or assumptions beyond that point, as we are actively trying not to inject “opinion” into the determination. Therefore, until we are presented clear contrary evidence, FCM will continue to include all three supply segments: escrow, undistributed and distributed in the total circulating calculation, thus XRP's circulating value on our site may be significantly larger than when compared to some other sites.”

While there’s nothing flawed in the FCM logic, this post was written in reaction to our XRP supply study.

So it’s noteworthy that FCM claims not to make any "speculative guesses" or “inject opinion” into their determination, as that’s basically an insinuation that “it’s too hard to figure out crypto’s equivalent of float, so f*ck it. ¯\_(ツ)_/¯”

No, actually. It’s not that hard.

It’s not that hard to define inputs to a liquid supply formula for a token supply curve. In fact, we’re actively trying to complete formulas for the entire asset class at Messari.

Because there are really only five supply curve inputs (although each have subcomponents):

Token Generation:

Regardless of which asset we’re talking about, there’s always an initial token generation event. Whether it’s fully generated up front or includes a predictable mining schedule, whether it’s inflationary or deflationary, whether it’s a scam or a legitimate project, every token has a genesis with an initial supply, and a prescriptive future maximum supply.

For Bitcoin, total issuance was capped *at its creation* and limited to 21 million units.

For XRP, 100% of the token supply was created at generation to be allocated over time.

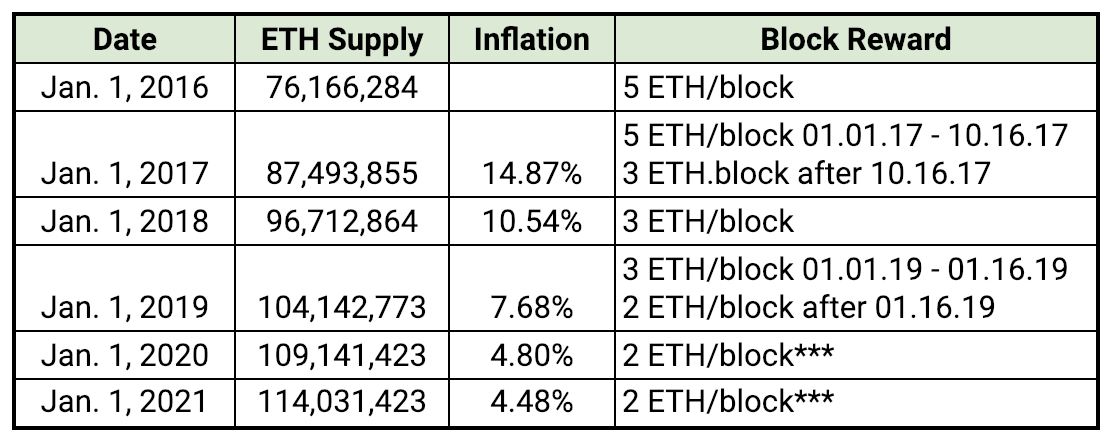

For Ethereum? Trick question of course. It didn’t have a maximum prescribed supply at genesis. Instead, the core team argued it would be inflationary for a while, and trend to “disinflationary” over time. That is, the rate of newly issued tokens would trend to zero, but the supply would be (at least technically) infinite.

Programmatic inflation:

A token’s initial supply is easy, because it’s a single snapshot in time before people start moving things around.

Things get hairier at any time “N” after the initial token generation. The most common type of new supply issuance is “programmatic inflation.” This is inflation embedded into the source code (or smart contract) of the token in question.

Bitcoin has it’s reward halving schedule.

XRP (and many other ICOs) have no programmatic inflation.

Ethereum highlights the edge case once again! It has defined inflation, but its community broadly recognizes the goal of the project’s core developers is to hard fork away from the current policy to a new, lower inflation rate.

At any time N, you know what the current programmatic inflation policy is, but future supply estimates also depend on assumptions surrounding potential changes to current inflation policy. (And yes, this applies to ANY cryptoasset, including bitcoin.) Communities have and will continue to exercise their right to hard fork inflation (or deflation) into any protocol.

(ConsenSys’s ETH inflation estimates, several days before the delay in Constantinople, and a corresponding inflation change, were due to be implemented.)

Programmatic deflation:

Some protocols “burn” tokens by design. Perhaps the most high-profile example of this is Binance Coin ($BNB), which uses a portion of the exchange’s quarterly profits to repurchase (and burn) outstanding BNB tokens.

The burn policy serves the same function as a “stock buyback,” but there could be other burn policies implemented in other protocols that serve as a disincentive to hoarding or that attempt to eliminate suspected “lost coins” from the money supply.

Many people debate whether lost coins should be included or excluded from a given money supply. But we’d argue this is a judgment call best left to individual investors or companies, so we can very easily include a “subjective” liquid supply which excludes lost coins, and a more “objective” liquid supply, which includes lost coins — unless they have been explicitly burned.

(From Messari’s BNB research page.)

Founders supply:

The last two categories are why we’ve invested so much time and mental energy (anguish?) into building Messari’s token disclosures registry.

If you want to truly understand the liquid supply of a given token, you can’t just look at the source code. You have to look at the people involved in the creation and maintenance of the token’s protocol itself.

Sorry, but there’s really no way around this for most assets that conducted an ICO or control a sizable chunk of the token supply and dev commits.

Founders supply can be tied to the foundation, company or people who initially sell a token, but hold some of that token in reserve. Knowing the details regarding an initial token sellers’ reserves and whether they are liquid or subject to vesting does quite a bit to preserve faith in the quality of the project and the focus of the team. An absence or outright obfuscation of details, on the other hand, raises red flags.

That’s why liquid supply is the single most important metric we’re estimating from the 20+ projects now on the Messari registry (we’re announcing the next cohort tomorrow).

We hope this type of detail will become the norm rather than the exception:

(Zilliqa’s supply curve, ZIL is a top 25 asset by our “liquid market cap” estimates.)

Community supply:

Only at long-last do we have what the traditional public equity markets would refer to as the “free float” of the asset.

This is how much is owned by third-party investors, partners, and developers.

Like “founders supply”, there are multiple components to measuring the liquid supply available in the community. Although, with community supply at least, you can usually assume most of the supply that’s been earned, gifted, or otherwise distributed is fully liquid. We see exceptions when certain assets are programmatically escrowed (vesting schedules in exchange for pre-sale discounts), or contractually restricted (e.g. Ripple’s volume-based selling restrictions).

Punch Line:

This sounds like more work than it really is.

Most of this information is out there, just waiting to be properly scraped. All we need is a little more proactive transparency from token sellers and ICO teams.

If we break token supply issuance down to its component parts, we can solve the liquid supply formula fairly easily.

Once we’ve laid out a clean supply curve and a reasonable assumption around liquid supply, we can layer on research and assumptions pertaining to token liquidity, and market depth. We can better gauge the price at which teams, investors, or token foundation treasury managers can actually sell their metric shittons of shitcoins on the open market.

Our bet is that the tokens associated with the most transparent teams will outperform in the long-term.

If you’d like to review or contribute to our “liquid cap” methodology, please drop us a line. We’ll be posting our liquid supply, markets data, and token team transparency methodologies for public review soon.

-TBI

P.S. Share. Subscribe. Spread the (rational) crypto love. Tweet at me or Messari for requests, feedback, comments, or questions.

Best of the Rest - What We Missed Last Week

Every weekend, we dig through the past week’s posts from crypto’s other great sources of content to see what we missed in our own weekend reads.

Here’s us curating the curators:

Why Monetary Maximalism could fall short of expectations - Hasu and Su Zhu

(h/t NLW)

Monetary maximalism is the idea that in a free market for money one big winner will emerge and that the “soundest” money is in the best position to do so. Most "bitcoin maximalists" identify as monetary maximalists based on their belief bitcoin will be the most successful (or only) crypto-money out of all public blockchains. But the authors note a variety of issues with maximalism in such a young industry including: the potentially misaligned incentives of corporations in the space; competition between blockchains (and their developer teams); the skewed behavior of mining pools; and pure tribal human biases. Each concern presents a challenge to the theory that bitcoin is the best “money” in crypto and that it will be the best money in the global economy.

Blockchain privacy: Equal parts theory and theater - Ian Miers

(h/t Token Daily)

Privacy is not dead. But according to Ian Miers the crypto community has done a poor job evaluating it. Concerns around privacy are not new, but Miers outlines why users of these networks should understand the limitations of information security and user anonymity, as well as the tooling that can help address these problems. Miers outlines the tradeoffs required by privacy technology, the types of attacks bad actors could launched against unsuspecting users, and the lessons he’s learned from failures to create and preserve privacy on the Internet.

Onboarding the Masses: Submarine Swaps- Matt B

(h/t ChainRift Research)

The Lightning Network is an elegant, early-stage solution to Bitcoin’s throughput limitations, but opening, using, maintaining and closing payment channels is still difficult. Lightning Labs engineer Alex Bosworth introduced a tool that exchanges on-chain funds for off-chain purchases via something called a “Submarine Swap” which allows any user to outsource Lightning integration, rebalance their portfolio of on- to off-chain assets, and "clean" certain coins by moving their transaction history off of the public Bitcoin blockchain.

Did I miss something?

Send me the link, your twitter handle and your best imitation compression algorithm write up. If I like it, I’ll include your bit next issue (with attribution).

Podcast Recap

🎧 ICYMI Ryan (TBI) and Arjun Balaji sat down for over an hour to discuss what they see happening in the industry during 2019. If you are a subscriber, make sure you have caught up on our two part series and check out Arjun’s theses for 2019.

You can view the full video here and as always you can listen and subscribe to all of our podcasts— on Apple Podcasts here, Spotify here, and Google play here.

Shameless Plugs

We want your feedback!

We know Messari can feel like a couple different products right now, and we're working to unify our features into one overarching whole. Head over to our new feedback tool and let us know what you think! 🛠

We're Hiring:

We need data engineers who want to bring transparency to crypto!

Join a fast growing team in NYC; work with crypto OGs, and former Bloomberg/Palantir engineers; & access a network that sets you up for the rest of your career. Apply here!

Join Our Community:

If you are interested in helping us crowdsource token project details, or want to join our community to share your expertise, we’d love to have you on board! Take a second to fill out an application and we will get back to you soon.

Going forward, we’ll be capping new members at 15 each week to keep things running smoothly. If you haven’t heard back, you are probably in the queue.

Like what you read? Share it! Hate what you read? Let me know @MessariCrypto.